Jump to a section

You know you have a personal credit score, but did you know your business has a credit score too?

A business credit score is not just a number; it's a critical indicator of your business’ financial stability and trustworthiness to pay back money. A healthy score can make all the difference when it comes to securing financing and getting favorable terms from lenders.

That's why taking the time to understand your business’ credit score and monitoring it regularly would be a wise move as a small business owner. By staying on top of your business’ credit score, you can unlock opportunities and position your business for long-term success.

What's a business credit score?

A business credit score is the number that represents how lending institutions view a business’ creditworthiness and illustrates its likelihood of obtaining funding. The better your business’ score, the more confident lenders are that your business will pay its debts, making it more likely for them to offer your business a higher credit limit.

Your business credit score is similar to your personal credit or FICO score. Personal credit scores range from a low of 300 to a high of 850 and most lenders require a score of at least 600 to qualify for a personal loan. On the other hand, a business credit score ranges from 0 to 100, with most business lenders requiring a score of at least 75.

Why is my business' credit score important?

A business credit score plays a significant role in a company's ability to access financing, and having a strong credit history is crucial for long-term success.

Failing to establish a good credit score could limit your business' access to credit, resulting in higher interest rates and collateral requirements. Moreover, business partners may view a low credit score as a sign of risk, which could negatively impact your business’ potential partnership opportunities.

How is a business credit score calculated?

A business credit score is calculated by credit reporting agencies (CRAs). In the US, there are 3 major CRAs that report on business credit scores: Dun & Bradstreet, Experian, and Equifax. CRAs look at multiple aspects of a business’ financial history to calculate its business credit score, taking into account information such as:

- Bill payment history if the business has borrowed before

- Whether the business has previously exceeded an overdraft limit

- How long the business has been running

- The industry - businesses in historically riskier industries including bars, restaurants, and retail are likely to have lower credit scores

- The size of the business - this is measured by CRAs either in annual revenue, owned assets, shareholders’ equity, or market capitalization

- The number of times the business has applied for credit in the past, and whether it was accepted or rejected

- Any trade credit

- Any outstanding debts the business may have such as loans and credit cards

- Assets - if the business owns any assets, such as property or land

- Any outstanding judgment lien against the business

Each CRA uses this information in a slightly different way, so the business’ score may be slightly different at each CRA.

Business credit score ranges

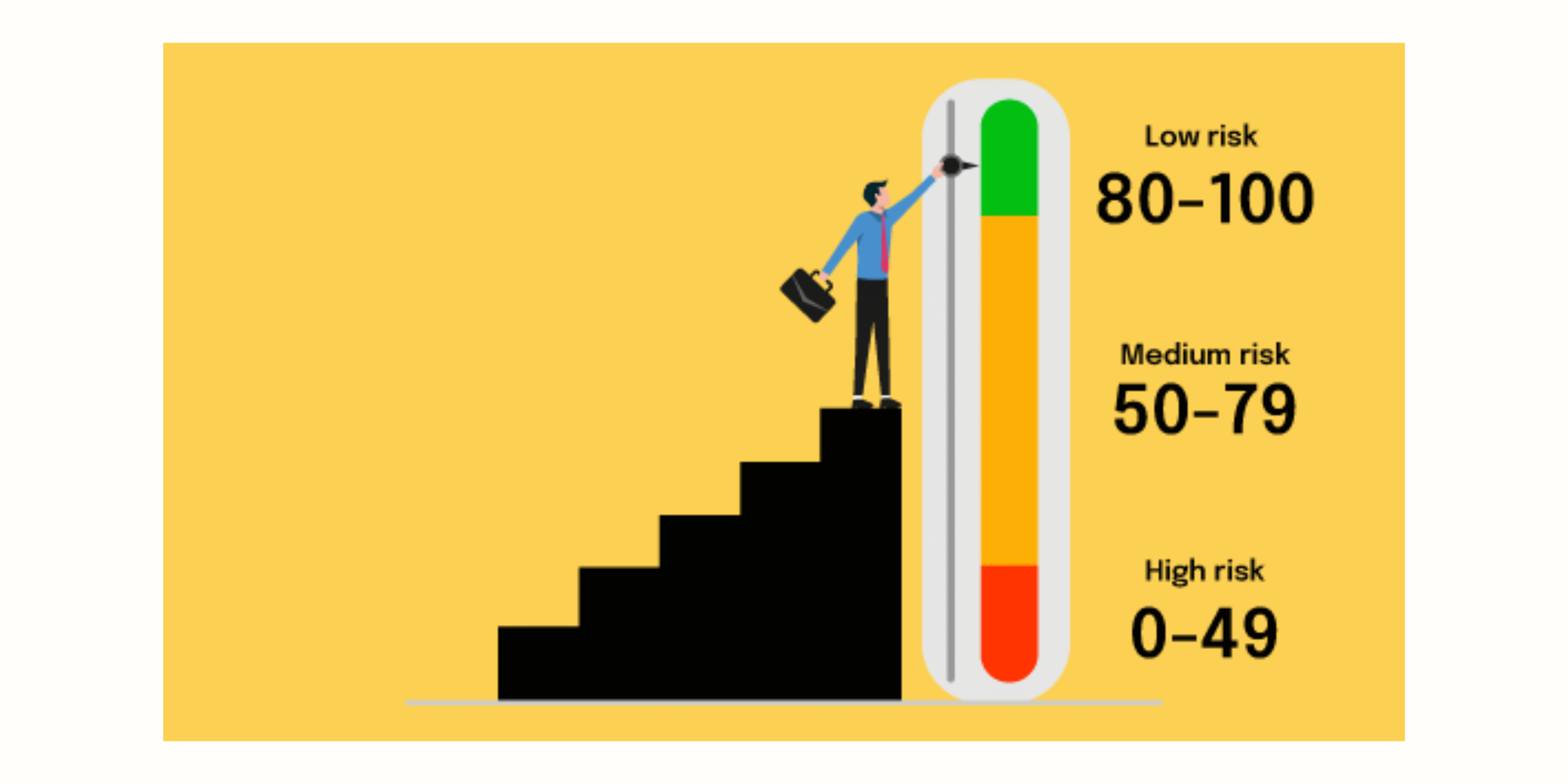

In the US, business credit scores range vary slightly between CRAs, but in general, credit score fall within the following ranges:

Low risk: 80-100

Medium risk: 50-79

High risk: 0-49

How to check my business credit score?

You can check and monitor your business credit score by obtaining a report from a CRA or credit monitoring agency.

Once you fill out the information requested, they will generate a report which includes your business credit score. You will usually receive this report via email, mail, or in an online account.

How can I get free business credit scores?

You can see your business’ credit score for free using many CRAs, but some may require payment for report breakdowns or monitoring credit scores over time.

CreditSafe provides businesses with a free credit score report, while CreditSignal by Dun & Bradstreet allows you to access your Dun & Bradstreet business credit scores and ratings for free during a two week trial period. However, to maintain continuous access to your business’ exact scores, you may need to purchase one of the credit monitoring or building solutions provided by the company or CRA.

Frequently asked questions

Small business owners’ frequently asked questions about business credit scores:

Is a business credit score different from a personal credit score?

Yes, a business credit score is different from a personal credit score.

A personal credit score is based on an individual's credit history and is used to evaluate their creditworthiness for personal loans, credit cards, and other personal financial products.

A business credit score is based on a company's credit history and is used to evaluate its creditworthiness for business loans, credit cards, and other business financial products.

Does a business have a credit score?

Yes, a business has a credit score.

Just like individuals, businesses have credit histories that are used to calculate credit scores. Credit scores for businesses are calculated based on factors such as payment history, credit utilization, length of credit history, and public records of the business.

What is a good business credit score?

A good business credit score can vary depending on the credit reporting agency and the industry, but generally, a score of 80 or above is considered good and indicates that the business is a low credit risk.

How to check my business credit score for free?

You can check your business credit score for free using credit monitoring platforms, but some may require payment for report breakdowns or monitoring credit scores over time.

CreditSafe provides businesses with a free credit score report. CreditSignal by Dun & Bradstreet allows you to access your Dun & Bradstreet business credit scores and ratings without any cost for two weeks.

Will a business loan or credit card affect my personal credit score?

Whether a business loan or credit card will affect your personal credit score depends on the type of financing and the lender's reporting practices.

If you apply for a business loan or credit card with a personal guarantee, making you personally liable for the debt, then the loan or credit card will likely appear on your personal credit report and impact your personal credit score.

On the other hand, if the financing is solely in the name of your business and you are not personally liable for the debt, then it may not appear on your personal credit report or affect your personal credit score.

It's important to review the terms and conditions of any financing agreement carefully and speak with the lender to understand how the loan or credit card will be reported to credit bureaus.

What is a good credit score for a small business?

There is no one-size-fits-all answer to what is a good credit score for a small business, as credit score ranges can vary depending on the credit reference agency and the industry. However, in general, a good credit score for a small business is a score of 80 or above.

Does a limited liability company (LLC) have a credit score?

Yes, a limited liability company (LLC) has a credit score. A limited liability company is a legal entity that is separate from its owners, and as such, it can establish its own credit history and credit score.

The credit score for a limited liability company is based on the company's payment history, credit utilization, length of credit history, and other factors.

Get started with a Capital on Tap Business Credit Card, issued by WebBank.

This does not constitute financial advice. If you want to understand credit financing options in detail, you should speak to your financial advisor or accountant.