Trusted by over 200,000 businesses

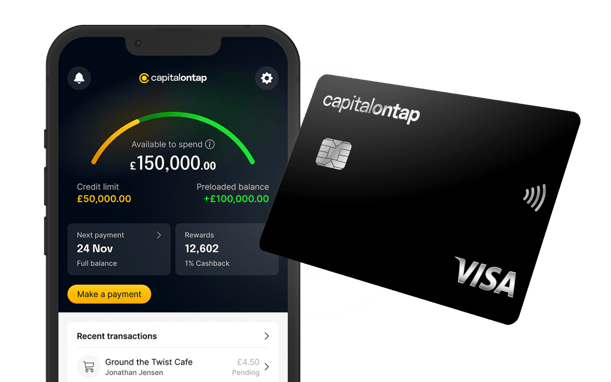

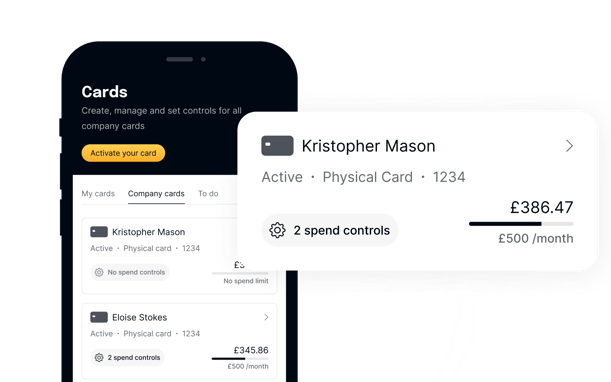

The credit card built for small businesses

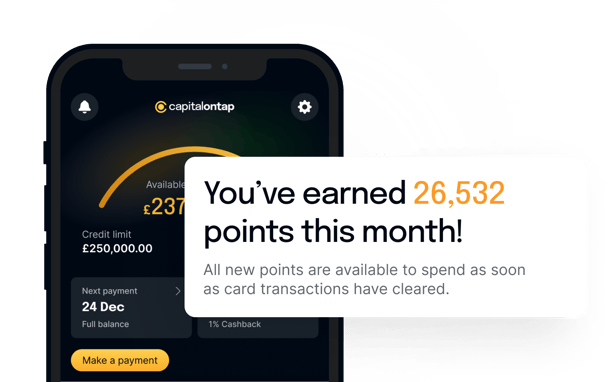

Get unlimited 1% cashback on all card spending. Redeem for cash, Avios, gift cards, or against your balance. Apply and get a decision in 2 minutes.

- Go further with credit limits up to £250,000

- 24/7 UK-based customer support

- No annual, FX, or ATM fees