Trusted by over 200,000 businesses

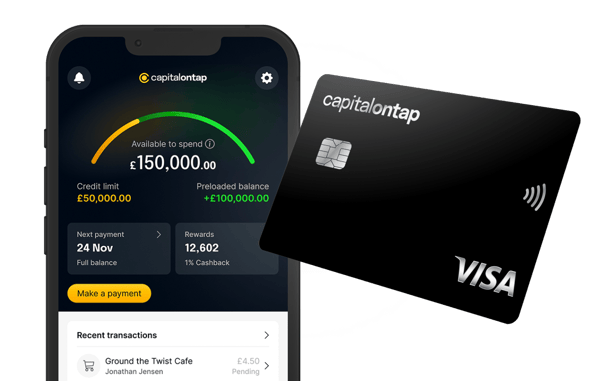

Cashback Business Credit Card

Get money back on everyday business expenses when you use a cashback business credit card.

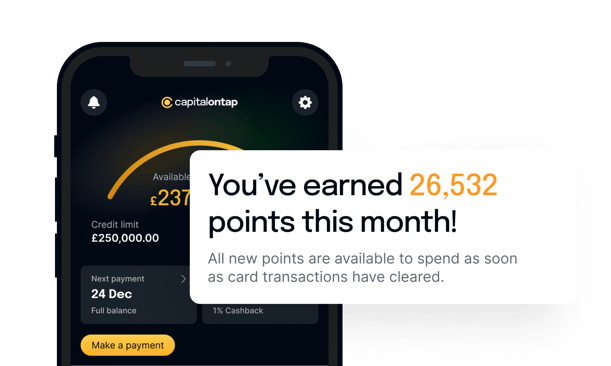

- 1% cashback on all card spend

- Redeem points for cashback, gift cards, and more

- No annual, FX, or ATM fees