Savings for Business

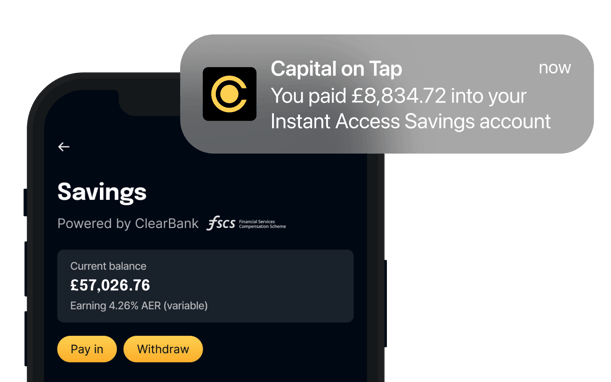

A market-leading business savings account (powered by ClearBank) is coming soon for our customers!

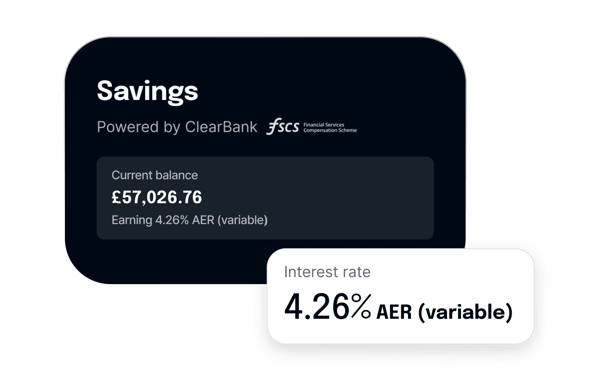

- 4.26% AER (variable) interest* on all your savings

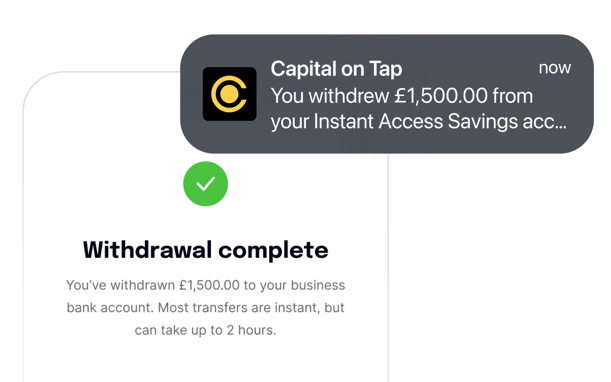

- Instant access to your funds

- Deposit as little as £1 with no maximum balance

Interested? Simply fill in your details below to let us know.

*based on today’s Bank of England base rate, and compared against other instant business savings accounts with no minimum deposit amount. Changes to the Bank of England base rate could mean that the rate offered at launch is different. The Annual Equivalent Rate (AER) demonstrates what you would earn in compounded interest on savings over 12 months as a percentage.

The Capital on Tap Instant Savings Account is powered by ClearBank; customers with an Instant Access Savings Account are introduced to ClearBank, with their deposits held by them as a ClearBank customer. ClearBank Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (No. 754568)

By clicking submit you confirm you have read and accepted the Privacy Policy, and agree to receive communications about Capital on Tap Instant Savings.