Jump to a section

When credit card balances and interest charges start accumulating, it can feel like an impossible quicksand trap - the more efforts made to get out, the deeper the debt sinks a company. Uncontrolled credit card debt can drain bandwidth, hurt cash flow, and cause sleepless nights for business owners. However, with strategy and discipline, it’s possible to recover. This blog takes you through the steps to get started.

Assessing the debt situation

Before you can start work on getting out of the debt, you need to be clear on how deep of a hole you're actually in. It's time for a brutally honest assessment of where your business is at with its credit card debt.

Gather up all your statements so you have them in one place, whether they’re digital or physical. Document all key info - interest rates, minimum payments, due dates, remaining balances on each card. Organise the pile from highest rate to lowest rate.

Now comes the tough part - total it all up. How much does your business actually owe across all cards? This can be nerve wracking, but you need to objectively gauge how heavy this debt burden is relative to your cash flow, revenue, and typical operating costs. Crunch some quick ratios to size up the impact.

Getting real about the severity of the debt gives you a crystal clear baseline. The good news is that finally facing reality allows us to start mapping out a comeback plan. We'll use this debt assessment as the foundation to methodically repay balances and restore financial health.

Creating a repayment plan

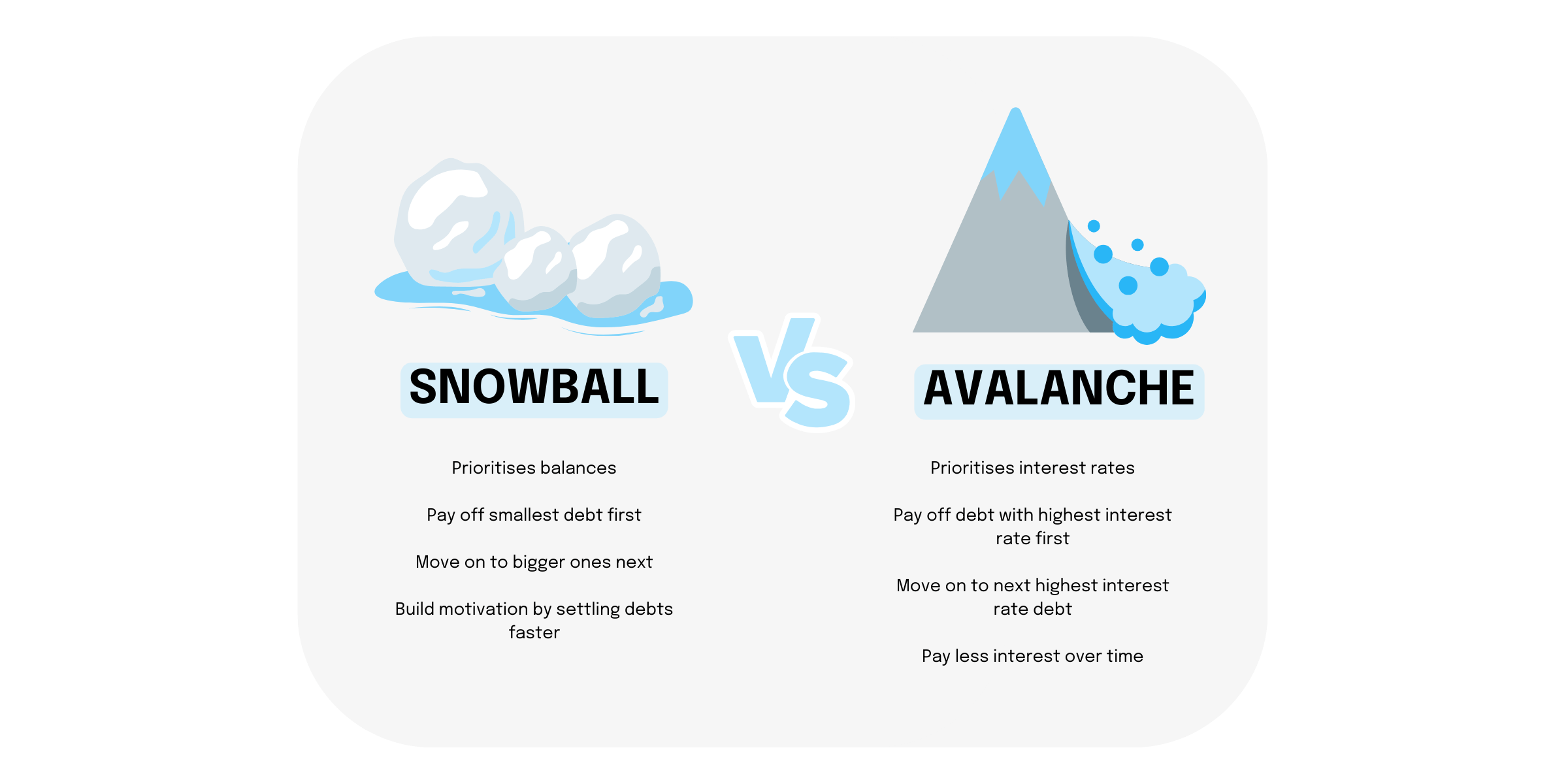

With a clear picture of the debt, develop a repayment plan. Popular strategies include the debt snowball method or the avalanche method. The debt snowball method prioritises paying off your smallest debt balances first, while making minimum payments on the rest. As each small debt is paid off, you roll the money you were paying on that debt into the next smallest balance. This creates a “snowball” effect, freeing up more money as you pay off each progressive balance and helping build momentum.

The debt avalanche method focuses on paying off the debts with the highest interest rates first, regardless of balance size. This method aims to reduce the total interest you pay overall. With the avalanche method, you’ll make minimum payments on all debts and put any extra funds towards the balance with the highest interest rate. Once that’s paid off, focus on the debt with the next highest rate.

The snowball method can give more short-term wins and motivation as you check off more accounts quickly. But the avalanche approach may make the most mathematical sense by cutting down high interest costs. Assess both to decide which strategy fits your situation best.

Choosing your strategy is just the first step. To make either method work, you need to carefully set realistic payment goals each month. Overly aggressive goals can quickly become discouraging, while undershooting can prolong the debt repayment timeline. Consider these tips when establishing your targets:

-

When setting repayment goals, be realistic about what is actually achievable each month based on your projected cash flow. Build in some buffer room rather than setting overly ambitious targets. Goals that stretch your limits are good, but make sure they are still within reach.

-

Develop a timeline with specific target dates for repaying each card based on your payment goals. Allow 3-6 months for smaller debts, and longer for larger balances. The timeline should motivate you but also recognise practical realities.

-

Map out target dates for major milestones like being 25%, 50%, or 75% of the way to paying off your total balance. Tracking these big wins will keep you motivated.

-

Continuously reevaluate the repayment plan and timeline. Adjust goals and dates if needed to keep things achievable. Staying flexible will prevent you from becoming discouraged.

Negotiating with credit card companies

Help may be possible through directly negotiating with your creditors. Credit card companies have a strong incentive to work with you to find a repayment solution that is sustainable for both sides.

Reach out to your credit card companies to explain your financial situation and discuss options to reduce the burden.

There are several potential outcomes that could provide some breathing room:

-

Lowering your interest rates - This reduces the amount going towards interest fees each month so more payments go to principal. Highlight your history of on-time payments if applicable.

-

Waiving late fees - Missed payments incur fees that then get tacked onto your balance. Ask for a one-time waiver to avoid further penalisation.

-

Reduced credit limits - Lower limits mean lower minimum payments so more can be allocated to balance reduction.

-

Balance consolidation - Transferring multiple high-rate balances to a new 0% introductory APR card saves on interest.

-

Extended repayment timeline - Negotiating a longer timeline for paying off a large balance can ease short-term burden.

The key is communicating openly about your financial realities and showing you are committed to repaying. Have account statements handy to talk specifics. Emphasise the desire to find a win-win solution so you can pay off the debt responsibility.

If you’re a Capital on Tap cardholder struggling to repay, give our friendly customer support team a call on 020 8962 7401 and they will be happy to help. We also have a dedicated specialist support team who are available to help you with your account management and offer repayment support whenever you need it.

Controlling expenses and budgeting

If you want to dig yourself out of credit card debt, you have to tighten up your budget and spending. We get it - it's not fun to cut expenses. But it's absolutely necessary if you want to free up more money to pay off those balances.

Take a good hard look at what your business is shelling out cash for every month. Are there things you can cancel or scale back? Even modest savings add up. Here are some places to start:

-

Cancel any "nice-to-have" subscriptions that aren't essential. Delete those video, music, or software services you don't really use. Downgrade plans if you can. Every pound you save contributes to the cause.

-

Renegotiate contracts with suppliers to bring costs down. You'd be surprised how much wiggle room you have.

-

Cut back on non-essential travel and entertainment. Limit meals out and trips unless they are directly generating revenue.

-

Pay attention to the little expenses too - small Amazon charges here and there add up fast. Reign it all in.

Now, you can't just starve essential business needs and expect to thrive. The goal is redirecting savings towards debt repayment while still funding must-haves. That's where budgeting comes in…

Prioritise building a budget that allocates maximum funds to paying off cards while covering truly critical operating expenses. Treat debt repayment like any other top-level budget item.

Creating a budget takes work, but it's hugely empowering. You'll have a plan, clarity, and confidence that you're optimising spend in the best way possible while methodically reducing your debt burden.

Generating additional revenue

Trimming expenses is important, but arguably the fastest way to demolish debt is bringing in more money. Consider if there are some creative ways to boost revenue that you can dedicate to credit card balances.

If you can find untapped opportunities to increase your income streams, even a little, it can speed up your debt repayment timeline significantly.

Here are some possibilities to explore:

-

Offer something new! Diversify your product or service lineup to appeal to different customers. Find holes in your portfolio that new offerings could fill.

-

Upsell existing customers who love your core product. Provide premium add-ons and upgrades.

-

Leading on from upselling, cross-sell complementary products and services to your client base. What else would delight them?

-

Find new sales channels to access untapped markets. Online? Retail? Get creative.

-

Optimise your marketing promotions and ad spend to attract new business efficiently.

It’s hard work when you’re just trying to keep up with day-to-day operations, and tackling debt repayment. But carving out just a bit of time to brainstorm new revenue opportunities can work magic. Of course, be strategic - only pursue ideas that represent the highest return on your time investment.

Seeking professional assistance

Digging yourself out of a big credit card debt hole on your own is really tough. Sometimes, it pays to get professional assistance. There's no shame in reaching out for help!

Credit counselling services and debt management agencies exist to help people just like you tackle problematic balances and fees. These experts can give you guidance, moral support, informed insights and access to helpful programmes.

Here are some of the ways they can help:

-

Provide tips and strategies for negotiating lower rates and payments with creditors. Their know-how and credibility can get more traction than you may be able to on your own.

-

Help you optimise and streamline monthly budgets to find more opportunities for debt payments. A second set of eyes helps.

-

Offer access to debt management plans that consolidate multiple payments to simplify and lower costs.

-

Connect you with additional resources, tools and education to help repay debt in a healthy way. You don't have to figure it all out alone.

Thoroughly review whoever you decide to seek help with - check reviews, complaints, credentials, all of it.

The bottom line

Recovering from significant business credit card debt requires diligence, discipline, and using multiple strategies simultaneously. But taking decisive action can put you back on the path to financial stability. Monitor progress frequently and be prepared to make adjustments to keep momentum going. With commitment and thoughtful execution, you can overcome debt burdens and look towards future growth.

This does not constitute financial advice. If you want to understand in detail, you should speak to your financial advisor or accountant.