Jump to a section

As a small business owner, you deserve financial solutions that work as hard as you do. That's why we're thrilled to introduce our new Instant Access Savings account, powered by ClearBank, and designed to help you make the most of your hard-earned money.

What's in it for you?

Our new savings account offers:

-

3.74% AER* (variable) interest on all your savings

-

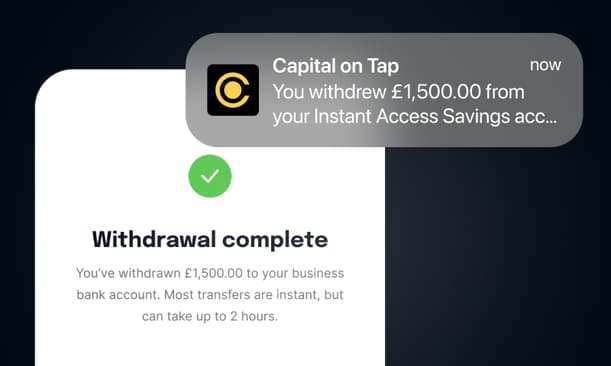

Instant access to your funds when you need them

-

No minimum balance - start saving with just £1

-

Unlimited deposits with no maximum balance restrictions

-

Zero monthly fees

-

FSCS protection on eligible deposits, up to £85,000**

Why choose the Capital on Tap Instant Savings account?

We understand the challenges you face as a small business owner. You need your money to work for you, but you also need quick access to funds when opportunities arise. Our Instant Access Savings account eliminates this compromise, offering both competitive returns and flexibility. Plus, with no maximum deposit restrictions, your potential for growth is virtually unlimited!

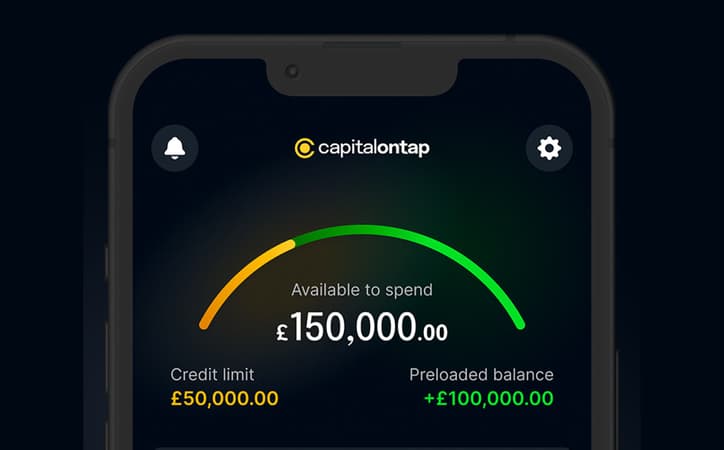

Already a Capital on Tap cardholder?

Great news! You can manage your new savings account directly through your portal. Enjoy the convenience of having your business credit card and savings all in one place, creating a comprehensive financial ecosystem for your business.

Getting started is easy. Simply log into your Capital on Tap portal to apply for your new savings account. If you’re eligible, your savings account will be open in a few simple steps.

Make your business cash work harder

Not yet with Capital on Tap? You don’t need to be! Our Instant Savings account is available to UK based business owners. Now's the perfect time to join the 200,000+ small businesses who trust us with their financial needs. Apply in minutes and start making your savings grow.

Apply for a savings account now!

Let's take your business finances to the next level together. Start saving smarter today with the Capital on Tap Instant Access Savings account!

* based on today’s Bank of England base rate. Changes to the Bank of England base rate could mean that the rate offered when you apply is different.

The Annual Equivalent Rate (AER) demonstrates what you would earn in compounded interest on savings over 12 months, as a percentage.

** Eligible deposits held in the Capital on Tap Instant Savings account, powered by ClearBank, are covered by the Financial Services Compensation Scheme (“FSCS”) subject to eligibility. All eligible deposits at the same bank are aggregated to determine the coverage level for each depositor up to £85,000, therefore if you have any other product/services with ClearBank these will be aggregated. To find out more and to check your eligibility please visit: fscs.org.uk/about-us/.