Jump to a section

Your Capital on Tap Business Credit Card is a valuable financial tool. But what if you could take it even further and boost your spending power beyond your credit limit? Now you can with our groundbreaking new Preloading feature.

Preloading allows you to top up your credit card balance with your own funds, and then use those preloaded funds together with your credit limit. This gives you greater flexibility in managing cash flow, taking advantage of 1% uncapped cashback, and more.

Best of all, there are no fees to use the Preloading feature, so you can take advantage of the benefits at no extra cost!

Benefits for small business owners

Preloading offers a number of valuable benefits for Capital on Tap business credit card holders:

-

Earn 1% uncapped cashback - Get 1% cashback on every pound spent on your card, including your preloaded funds. There are no limits.

-

Boosted cashback for Pro customers - If you’re signed up to the Pro plan, you earn 1.25% cashback on all spend from preloaded funds.

-

Increase your spending power - Preloading lets you boost your balance beyond your credit limit so you can keep spending when you need to. Never worry about hitting your limit again.

-

Pay down balances faster - Prepay pending balances immediately to free up credit and simplify accounting.

-

Smooth cash flow - Combine credit card and preloaded funds for seamless spending and cash flow management.

-

Simple accounting - All spending shows on one monthly statement, both credit and preloaded.

-

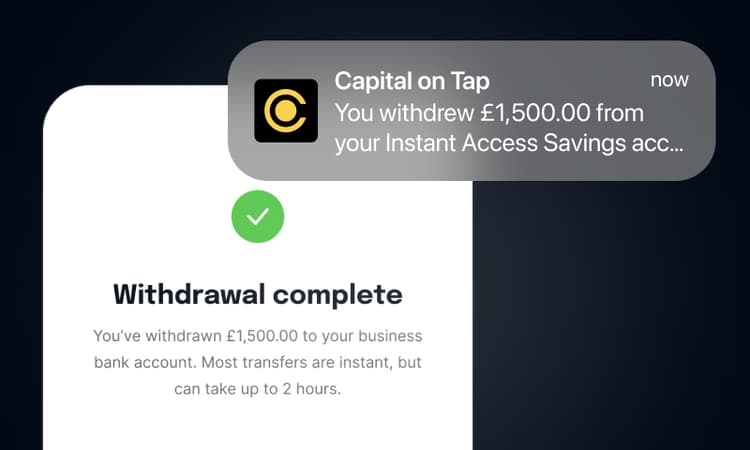

Instant availability - Top up your card and see funds available almost instantly.

-

Flexibility - Preload as much or as little as you need, whenever you need. No restrictions.

Preloading gives unmatched flexibility and control over expenses.

How Preloading works

Preloading is a free feature for all our business credit card customers and takes just minutes to set up. Get started today through the online portal or mobile app by following these four simple steps:

Step 1

Head to the Payments tab in your account and click ‘Preload’.

Step 2

Click ‘Make a one-off bank transfer’ to find the necessary account information. Please note, if you haven’t read and accepted the ‘E-Money Facility Agreement’ yet, you will be prompted to do so here.

Step 3

Copy these details and use them to add Capital on Tap as a payee in your online banking.

Step 4

Make sure to remove the old Capital on Tap bank details from your payees list to avoid errors.

Remember, you can only transfer from the bank account we have on file for you. You can verify this by checking your account details here.

Frequently Asked Questions

Why do I need to sign an E-Money Facility Agreement?

Customers who joined Capital on Tap after May 2024 will have signed the E-Money Facility Agreement during their onboarding process, as it is mandatory. Customers who joined before May 2024 can choose to sign it or not, but they won’t be able to access the Preloading feature unless they do. This is because when you give us your money, it becomes electronic money (E-Money) and is therefore subject to specific rules around how we safeguard it. If you are unsure if you've already signed the agreement, here’s how you can check:

-

Log in to your account via the app or online portal

-

Go to ‘Your Account’

-

Click on ‘Rates and Contracts’

-

If you can see the E-Money contract here, you’ve already signed it; if it’s not there, it means you still have to sign it.

More questions? Check out our FAQs.

Can I transfer my money back?

If you change your mind about using Preloading, we can refund any unspent funds to your business bank account. Just give us a ring at any time on 020 8962 7401 and our friendly customer service team will be happy to help.

How is my money protected?

We are authorised as an E-Money Institution with the FCA. If you become a Preloading customer with us, any funds you send to us, that take your account into credit, will be treated as E-Money and be subject to the safeguarding requirements set out in the Electronic Money Regulations.

Capital on Tap is not a bank and your funds are not protected in the same way that a bank would protect your funds, instead we place these funds into a separate bank account that protects your money and allows its safe return to you in the event that Capital on Tap becomes insolvent or otherwise closes down.

How do our customers use the Preloading feature?

Businesses of all sizes can leverage the Preloading feature on their Capital on Tap card to enhance flexibility and maximise value.

By adding funds to the card, you can make payments that exceed your credit limit. For example, if your credit limit is £10,000, but you need to make a payment of £20,000, you can preload an extra £10,000 to cover the difference and successfully complete the payment. Plus, you’ll earn 1% cashback on the total amount. And if you’re a Pro customer, you’ll get 1.25% back on all your preloaded spend!

Many of our customers preload funds for upcoming bills in a single transaction, eliminating the need for multiple transfers. Additionally, you can set up weekly or bi-weekly bank transfers from your bank to streamline the process.