Jump to a section

According to research from the Federation of Small Businesses (FSB), 50,000 business closures could be avoided each year if late payments had been made on time. Unpaid invoices can have a big impact on cash flow, especially for smaller businesses, and can also impact stress and productivity levels.

Worryingly though, our new research has found that only 1% of small businesses have never had to deal with an overdue invoice, but what is the true cost of these?

To find out, we’ve delved a little deeper with our survey, asking 250 small business owners about how often they have to chase unpaid invoices, how much income they are waiting to receive, and also which industries they find to be the worst culprits when it comes to late payments. The team has also provided some top tips for how to successfully chase overdue invoices.

Industries most likely to be impacted by unpaid invoices

According to those surveyed, businesses in the UK are spending an average of eight days chasing unpaid invoices. On top of this, those overdue invoices are equating to just under £1,350 in lost income at any given time.

However, the study has revealed that the impact of unpaid invoices actually varies significantly across different industries. We’ve taken a closer look at which sectors have been hit the hardest.

Which industries are spending the most time chasing overdue invoices?

Chasing late payments can be incredibly time-consuming, especially when there is more than one unpaid invoice, and it becomes a recurring issue.

In terms of time spent, the education sector has been impacted the most by overdue invoices. Businesses in the sector are having to chase late payments around 11 times every month, according to those surveyed.

In second place is the home furnishing industry, with business owners following up on delayed payments 10 times a month. In joint third place are those in the healthcare, electrical services, and consulting sectors, with companies in these industries having to chase unpaid invoices around nine times per month.

In terms of who is least likely to be impacted, those in the restaurant and food industry are having to follow up just four times per month, which while still substantial, is almost three times less than those in the education sector.

|

Rank |

Industry |

No. of times business owners chase unpaid invoices per month |

|

1 |

Education |

11 |

|

2 |

Home furnishings |

10 |

|

=3 |

Health care |

9 |

|

=3 |

Electrical Services |

9 |

|

=3 |

Consulting |

9 |

|

=4 |

Retailers (except food & drug) |

8 |

|

=4 |

Leisure Goods & Services |

8 |

Which industries are missing out on the most money due to unpaid invoices?

Delayed payments can also have a big impact on cash flow, and, as we’ve previously mentioned, in some severe cases they’ve led to businesses going under.

When it comes to the monetary impact of late payments, retailers are currently being affected the most. According to those surveyed, businesses in the industry are facing around £1,532 worth of overdue invoices at any given time.

In second place are those in the electrical services sector, with businesses waiting for £1,501, on average. Businesses in the industrial equipment sector have come in third, with owners suggesting they have around £1,451 wrapped up in unpaid invoices.

On the other end of the scale, small businesses in the property management and development sector are seeing the least financial impact. However, according to those surveyed, owners in the industry are still waiting on an average of £1,032 in unpaid invoices, which is still a significant amount of money, especially for smaller businesses.

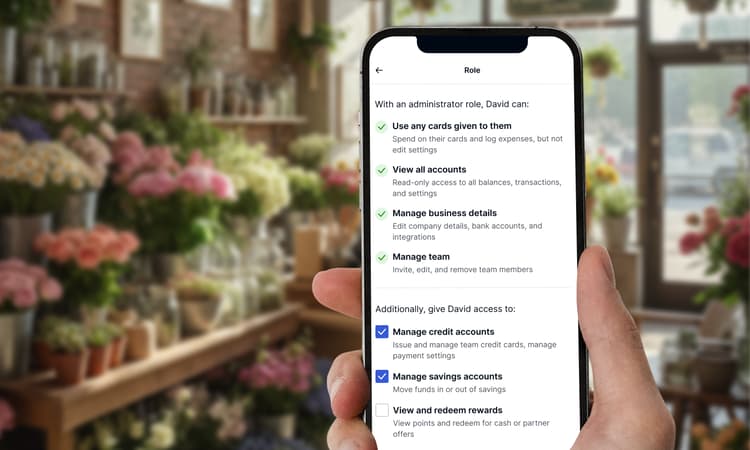

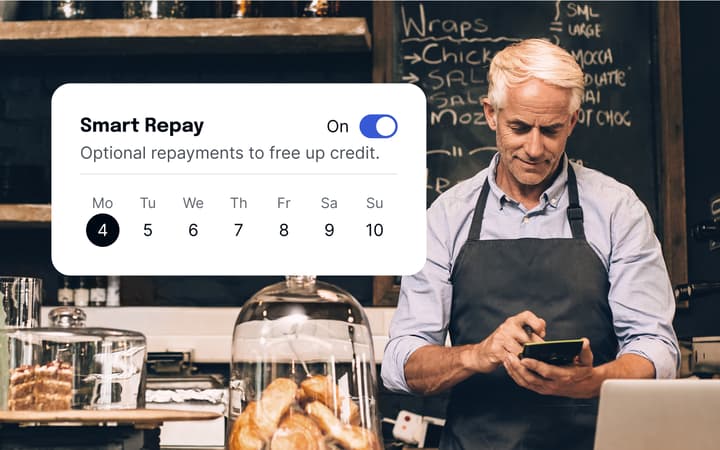

If you do find that your cash flow is being impacted because of late payments, taking out a business credit card can be really beneficial to bridge the gap while you’re chasing invoices.

|

Rank |

Industry |

Amount of money business owners are waiting on due to unpaid invoices |

|

1 |

Retailers (except food & drug) |

£1,532 |

|

2 |

Electrical Services |

£1,501 |

|

3 |

Industrial equipment: Nonferrous metals/minerals |

£1,451 |

|

4 |

Health care |

£1,448 |

|

5 |

Containers & glass products |

£1,426 |

Which areas in the UK are being hit the hardest by unpaid invoices?

As our research has shown, the type of industry can impact how affected a business is by late payments, but we’ve also found that where a company is based can also play a part.

The north of England seems to be hit the hardest when it comes to time spent chasing invoices, with SMEs in Sheffield having to follow up with customers a huge 16 times every month. This is closely followed by companies in Manchester who are chasing delayed payments 12 times a month, on average. In third is Belfast, with owners admitting to dealing with overdue invoices about 11 times a month.

Meanwhile, businesses in Southampton are having to spend the least time chasing late payments, with owners suggesting they do so about three times per month.

Financially it’s a different story, with companies in the south of England seeing the most money wrapped up in unpaid invoices. Small businesses in Plymouth are impacted the most, with owners waiting for around £1,801, followed by Bristol businesses which are missing £1,733, on average.

Businesses in Edinburgh see the lowest financial impact, with around £876 worth of invoices outstanding at any given time.

Industries most likely to be delaying paying their invoices

Some industries are guiltier than others when it comes to how late their invoices are paid, our research shows.

Financial providers are the worst culprits when it comes to delayed payments, with those surveyed suggesting over half (52%) of all invoices have been paid late by businesses in the industry. Following closely behind are those in the building and development (51%) and equipment leasing (50%) industries.

When it comes to who is the best at paying invoices on time, businesses in the publishing industry and the food retail sector both take the crown, though two-fifths (41%) of invoices are still paid late by these industries.

|

Rank |

Industry |

% of late payments from businesses in the industry |

|

1 |

Finance Providers |

52% |

|

2 |

Building & Development |

51% |

|

3 |

Equipment leasing |

50% |

|

4 |

Beverage and tobacco |

49% |

|

5 |

Food products |

48% |

Tips for chasing unpaid invoices

Dealing with late payments can be stressful, and asking for money from a customer can also be a little uncomfortable. With this in mind, Alex Miles, COO and UK Managing Director at Capital on Tap has shared some tips for chasing unpaid invoices:

1. Set a timeframe

It’s important to establish a process for chasing payments. Setting a timeframe for yourself can make it feel more manageable, and also less personal if you feel a little uncomfortable chasing a customer for money.

It’s also important to set your expectations for payment deadlines when you invoice the client, so you’re both on the same page. Most SMEs will opt for a 30-day payment deadline, but think about what will work best for you and your business.

2. Don't be afraid to check in

It’s not rude to chase your invoices. In the first instance of a late payment, send your customer an email to check if there’s been a problem with processing, remind them it’s overdue, and ask when you can expect the payment.

If they still haven’t paid, send an overdue invoice, and if the problem persists then give them a call. It’s harder for a customer to ignore you on the phone. You don’t need to say too much, just explain the overdue invoice and ask when it will be paid.

Also, make sure you’re communicating with the right person. It might be that the best contact sits within the accounts or admin team, so find out who you need to speak with, and exactly what they need to sort your payment.

3. Escalate if needed

If you’ve contacted the customer by both email and phone but they still haven’t paid, then you’ll need to escalate the issue.

Warn them that you might stop supply if they don’t pay, and speak to someone more senior in the business if you can.

It’s also worth considering adding a late payment fee or interest rate to your invoices, so if you do come up against a delayed payment, you can charge the customer for the inconvenience. You can’t add this out of the blue though, so make sure you’re upfront about it in your terms.

4. Seek professional help

If the problem persists, you may need to seek professional advice. This might involve using government or local business advice hubs, calling your trade organisation to see what help they can offer, speaking to a solicitor or accountant, or using a mediator to talk things through with the customer.

In the most extreme cases, you could also take legal action, though this would no doubt be a further strain on resources, and might impact your existing relationship with the customer.

5. Make sure you’re paying your own invoices on time too

As the age-old saying goes, ‘people in glass houses shouldn’t throw stones,’ and as a business owner yourself, it’s really important to make sure you’re also paying invoices on time. Communication is also key, so if you do find yourself behind on payments, whether that be because of illness, holidays, or other contributing factors, be open and honest with your suppliers so you can fix the problem as quickly as possible.

As we’ve mentioned previously, if you do find that you’re struggling with cash flow because of late payments, taking out a business credit card can be a really helpful tool to tide you over. It can give you greater financial freedom and keep operations running smoothly until you manage to chase all of your unpaid invoices.

Methodology & Sources

Survey was conducted on 250 UK small business owners over the age of 18, in September 2023.

This does not constitute financial or legal advice. If you wish to understand issues with invoices, contact your financial advisor or accountant.