Jump to a section

As a small business owner, you have undoubtedly been swarmed with offers for business credit cards. While they are quick to tout their value, you may be left wondering - what’s the point if I can just use my personal card for business expenses? The truth is, there are a lot of benefits of using a business vs personal credit card that extend far beyond what you’ve seen in the ads.

What are the main differences between business and personal credit cards?

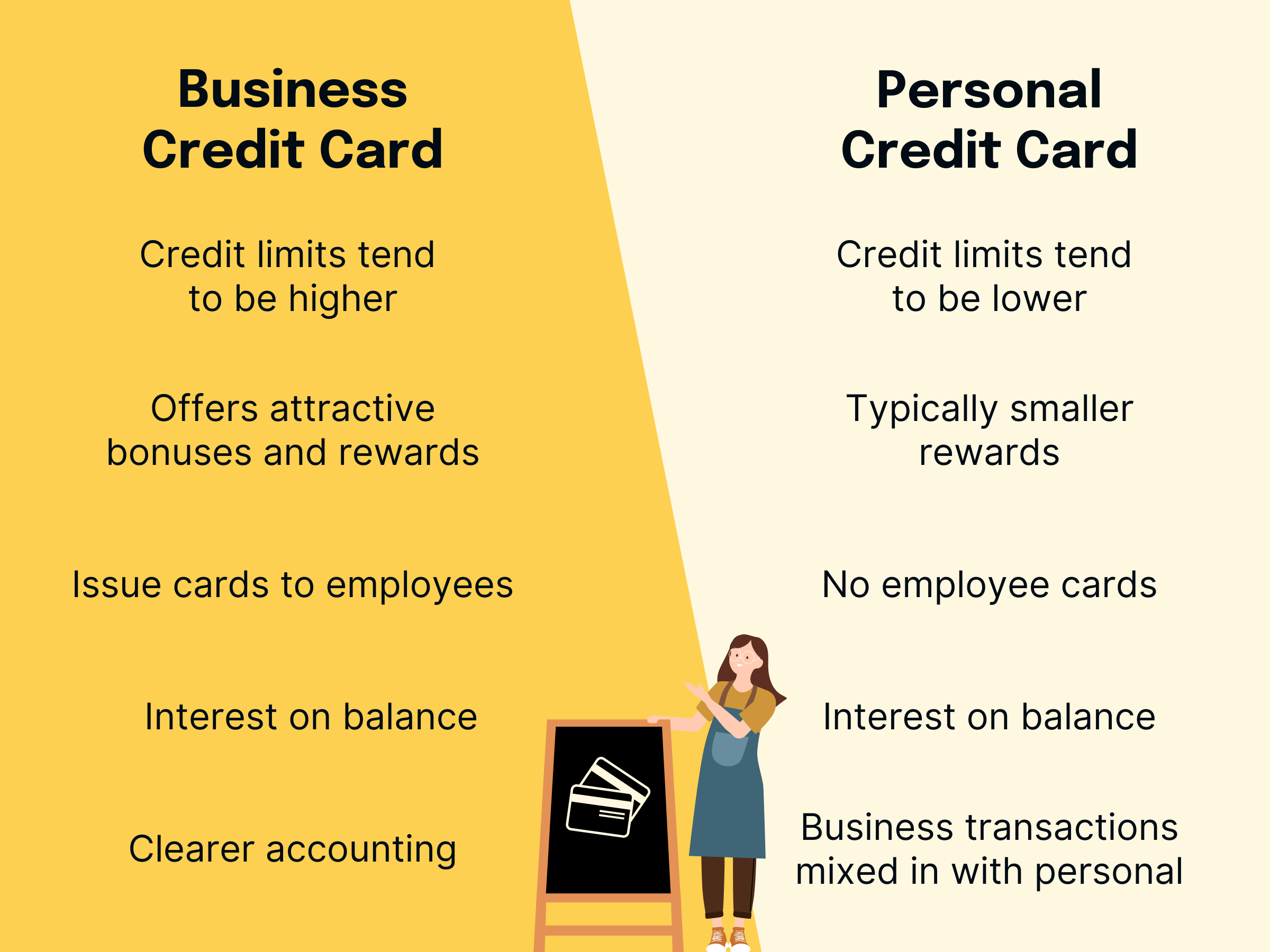

The core difference between business and personal credit cards is that business credit cards are issued to businesses, report to business credit bureaus, and can help build business credit. The same is true in reverse for personal credit cards, which are issued to individuals, report to personal credit bureaus, and can help build credit for the individual.

Typically, the benefits of business credit cards are better (higher credit limits, more rewards, etc.) because more money tends to move in and out of businesses than personal accounts.

Business credit cards offer higher credit limits

Business credit cards generally have higher credit limits than personal credit cards. Limits are usually determined by your business's revenue and spending. For example, the Capital on Tap Business Credit Card offers limits of up to £250,000.

On the other hand, personal credit cards offer lower limits based on your personal income. These limits are often more conservative and may not be suitable for larger or recurring business expenses.

Business credit cards give better rewards and perks

Business credit cards often come with rewards tailored for companies. For instance, the Capital on Tap Business Credit Card offers 1% uncapped cashback on everyday business purchases. Points can also be redeemed against your balance, converted to Avios, or as gift cards with major retailers like Amazon, Airbnb, and more!

While personal credit cards also offer rewards, they tend to focus on general consumer categories like dining, travel, or groceries and don’t offer business-specific perks.

Business credit cards build business credit (not personal)

Business credit cards report to commercial credit bureaus, helping you build your business credit profile. Most business credit cards, including Capital on Tap, do not report to personal credit bureaus unless payments are missed.

In contrast, personal credit cards report directly to personal credit bureaus, affecting your individual credit score. This is why it's important not to mix personal and business spending—it can affect your credit and make bookkeeping more difficult.

Business credit cards make bookkeeping easier

One major advantage of a business credit card is the ability to clearly separate your business expenses from your personal ones. This makes financial tracking and tax preparation much easier. Many business credit cards also integrate with accounting platforms such as Xero, QuickBooks, Sage, and FreeAgent. The Capital on Tap Business Credit Card, for example, offers seamless integration with all of these.

Using a personal credit card for business purchases can result in a muddled transaction history, making it harder to track expenses, categorise them accurately, or prepare for tax time.

Business and personal cards provide separate lines of credit

A business credit card provides a separate line of credit exclusively for business use. This not only helps keep your finances organised but also contributes to building a strong business credit profile.

Personal credit cards do not offer this benefit. While you can use a personal card for business purchases, it won't help your business credit and it can complicate accounting. Please note that the reverse is not true: you cannot use a business credit card to pay for personal expenses.

How do I get a business credit card?

There are certain steps you should take before you apply for a business credit card:

1. Find the right card for you: The first step is to compare the different fees, benefits, rewards, and other features of different business credit cards to find the right one for you.

2. Check your eligibility: Once you’ve found the right card for you, make sure you meet the eligibility criteria. These can include:

-

Being 18 years or older.

-

Having a UK registered business.

-

Your revenue.

You’re eligible for a Capital on Tap Business Credit Card if:

-

You are an active director of the company or majority shareholder of 25%+ ownership. If neither of these titles matches your role within the company we will unfortunately not be able to accept your application.

-

You and your business are based in the UK.

-

Your business has a turnover of at least £24,000 per year.

-

You have no unsatisfied CCJs against you or your business in the last 12 months.

-

Your business is registered as a private limited company (Ltd) or limited liability partnership (LLP).

3. Apply for the card: Gather the information you’ll need to apply. Fill out the application carefully, then await your credit decision. Applying for the Capital on Tap Business Credit Card takes just two minutes and the majority of applicants receive an instant decision!

4. Set yourself up for success: Before using your card, make sure you have a budget and payment plan to ensure responsible use and avoid accumulating debt.

The benefits of keeping your business expenses separate from personal finances

As a small business owner, it can be tempting to use the same bank account for both personal and professional expenses. However, keeping a separate account for your business can be beneficial for a few reasons.

Easier cash flow management

By separating your business finances from your personal, you can improve your cashflow by making it easier to track income and expenses in the short term. It also makes budgeting simpler, as you just have to look at one statement per account type, rather than sorting through different transactions. Starling found that the average small business spends ten weeks a year sorting their finances - valuable time that could be spent on growing your business.

Improve your accounting

When it comes to tax season, having separate business and personal expenses can be a lifesaver. Keeping track of expenses for tax deductions becomes much simpler when they are all organised in one place.

Beyond that, having clearly defined expenses can provide added protection in the event of an audit. Any personal purchases or payments can easily be distinguished from business purchases.

Company cards

One great perk of having a business credit card is the ability to issue employee cards. These cards can be set with spending limits and used for company expenses such as travel, office supplies, or client gifts.

This not only saves time and energy for employee purchases, but it also helps with budgeting and accounting. Instead of juggling personal expenses and company expenses on one statement, employee cards allow for clear categorisation.

If you're approved for the Capital on Tap Business Credit Card, you can create an unlimited amount of cards for your employees, with easy management from your app or account.

Additionally, Capital on Tap account holders can now create up to five virtual cards for the main account holder, as well as up to five individual virtual cards for employees.

Protect your business

Mixing personal and business expenses means you run the risk of commingling assets, which can open you up to legal liability in the event that your business is sued. By keeping your business expenses clearly marked and separate, you establish a clear paper trail that shows the distinction between personal and business funds.

This can protect you both financially and legally, as it allows for easy audits and reduces the chance of any confusion or misconceptions about where funds are coming from or going to.

What are the risks of getting a business credit card?

Before you apply for any type of credit, it's important to consider the potential risks. Just like with a personal credit card, the biggest risk is often overspending money you can’t pay back. However, when used responsibly and with careful budgeting, a business credit card can offer some major benefits. In addition to a crucial line of credit to grow your business, these benefits also include building your business credit, earning rewards and perks, streamlining expenses, and providing financial flexibility.

At the end of the day, it's up to every business owner to weigh the potential risks against the potential benefits and make an informed decision about whether a business credit card is right for their company. Just remember- use it responsibly!

Frequently Asked Questions

Do I need to have a large business to get a business credit card?

Contrary to popular belief, having a business credit card is not reserved only for big companies. In fact, it can be an essential financial tool for small businesses as well.

Do you have to use a business credit card for business expenses?

Yes, a business credit card must be used exclusively for business expenses. Should you use a business credit card for anything else, you risk your credit card being closed and penalties for both your business and personal credit scores.

Is business credit better than personal?

If you’re looking for a way to fund your business, a business credit card is far superior to a personal credit card in this capacity. In addition to higher credit limits and improved rewards, a dedicated line of credit for your business is more suited to help you grow your business over time than a credit card created for personal use.

When weighing your business vs personal credit card options, make sure to consider the Capital on Tap Business Credit Card. With unlimited free 1% cashback on card spend, unlimited employee cards, and no annual or foreign exchange fees, the Capital on Tap Business Credit Card is custom-built for small businesses.