Trusted by over 200,000 businesses

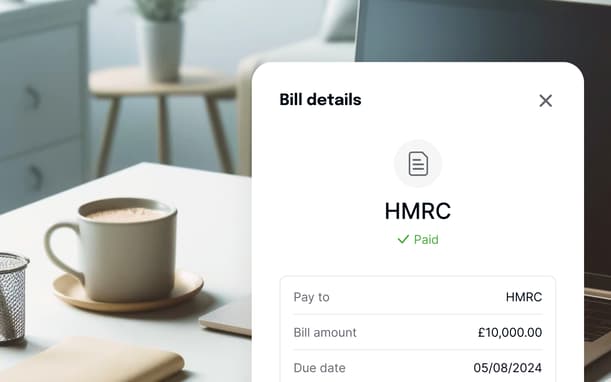

Pay vendors using your line of credit with Bill Pay

Effortlessly pay suppliers even if they don’t accept credit cards, for a fee as low as 1%.

- Pay suppliers, contractors, and employees from your credit line

- Enjoy interest-free payment terms on any bill

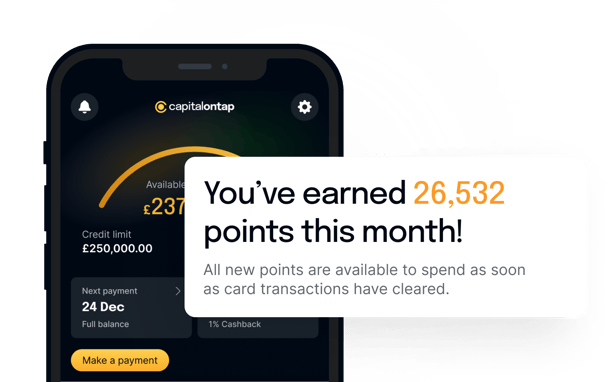

- Get up to 1.25% cashback* for a 2% flat fee