Trusted by over 200,000 businesses

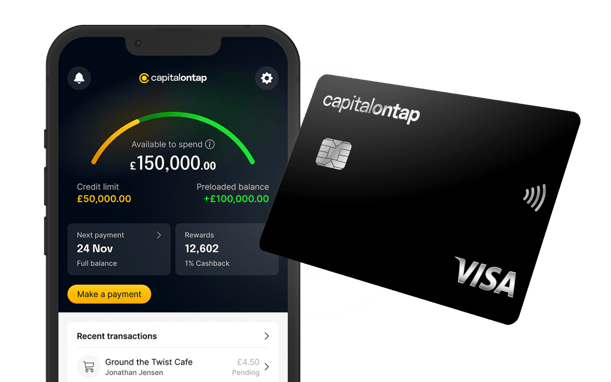

Cashback Business Credit Card

Get money back on everyday business expenses when you use a cashback business credit card.

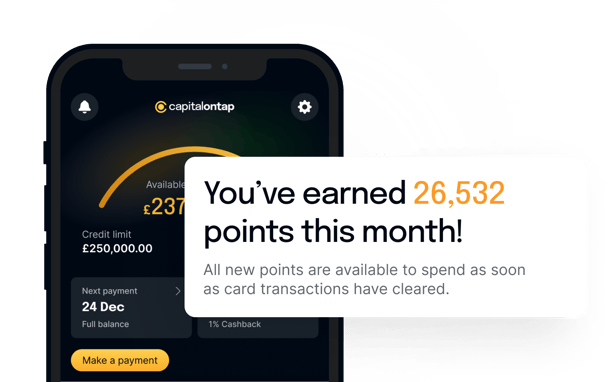

- Unlimited 1% cashback on card spend

- Redeem points for cashback, gift cards, and more

- Convert points to Avios for free