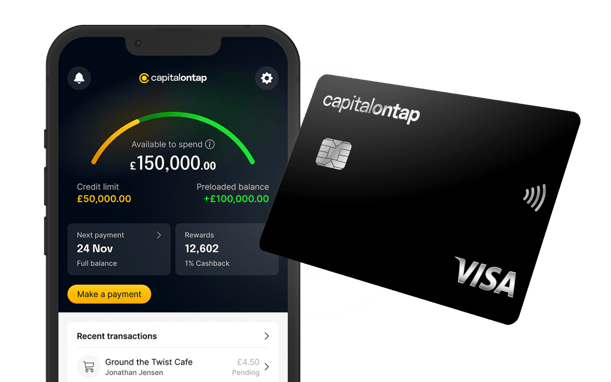

1% cashback on all card spend

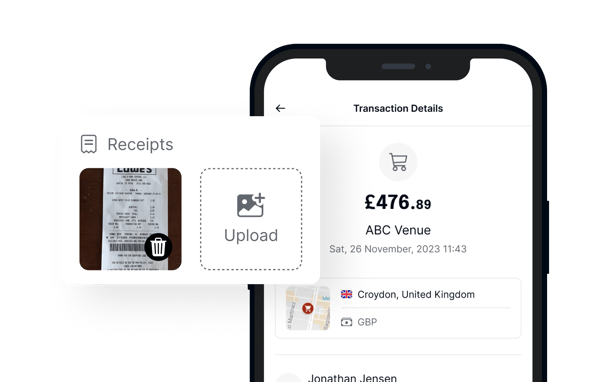

Free expense tracking and management

Stop wasting time manually managing expenses. Let Capital on Tap's free, all-in-one spend solution make running your business easier by allowing you to:

- Auto-sync with your accounting software

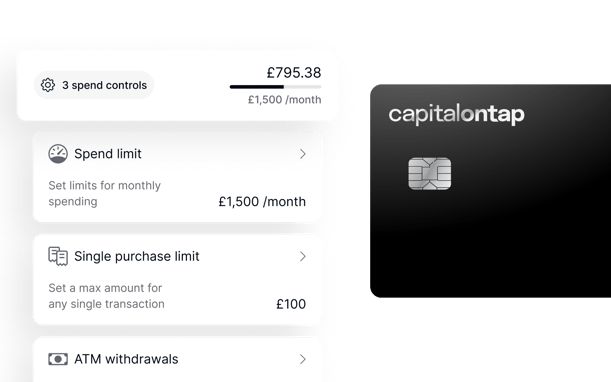

- Track card spending in real time

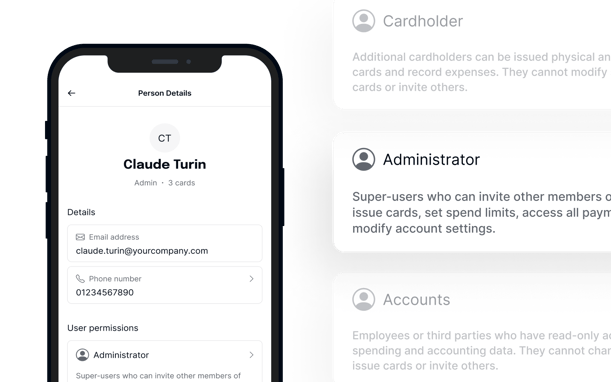

- Delegate financial management