Trusted by over 200,000 businesses

Business travel credit card

Make the most of your business trips with unlimited airport lounge access and Avios conversion.

- Convert points to Avios or Virgin Points for travel

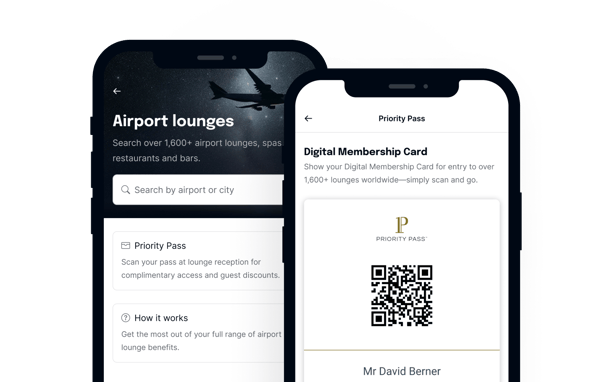

- Access 1,600+ airport lounges worldwide

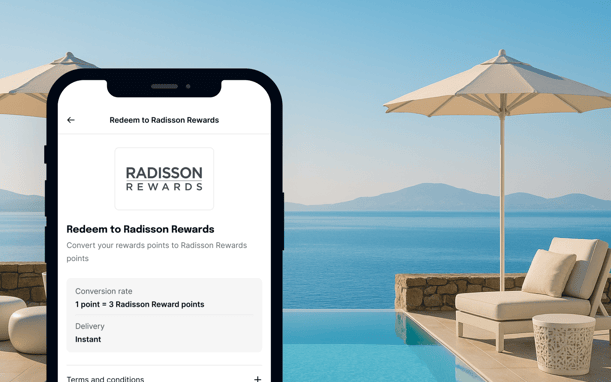

- Enjoy Radisson Rewards VIP status