1% cashback on all card spend

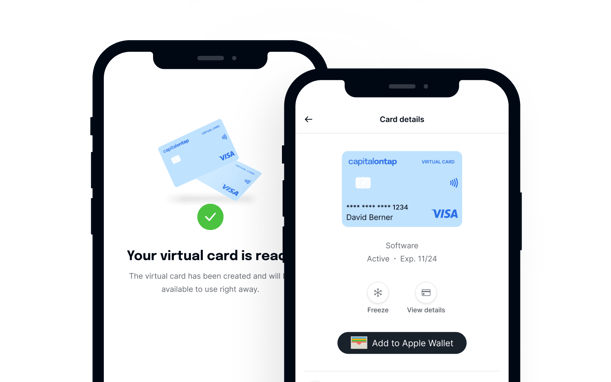

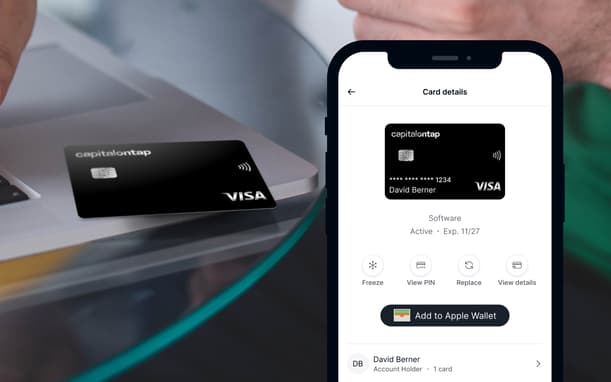

Virtual credit cards for business

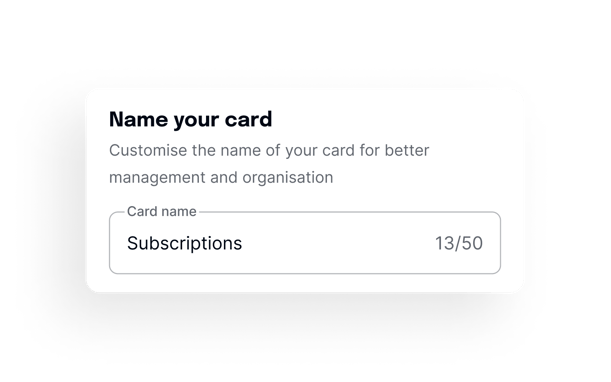

Protect your business with virtual credit cards. Create and terminate cards easily, segment your spending, and protect yourself from fraud.

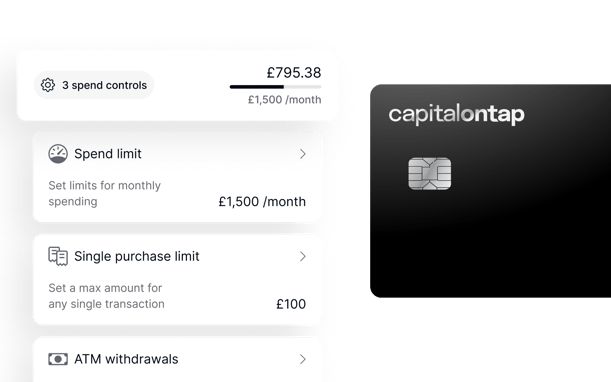

- Set spending limits

- Minimise the risk of fraud

- Efficiently manage project costs