Zero monthly fees

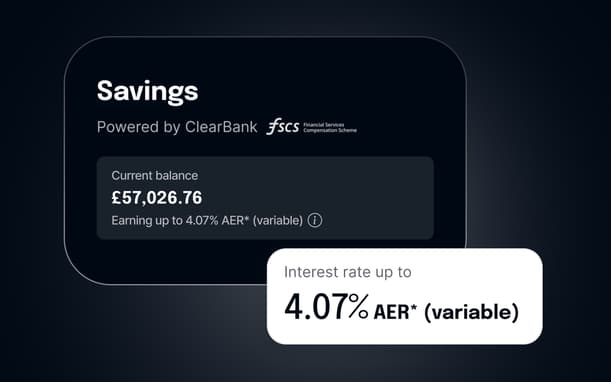

Up to 4.07% AER* (variable) Instant Savings account

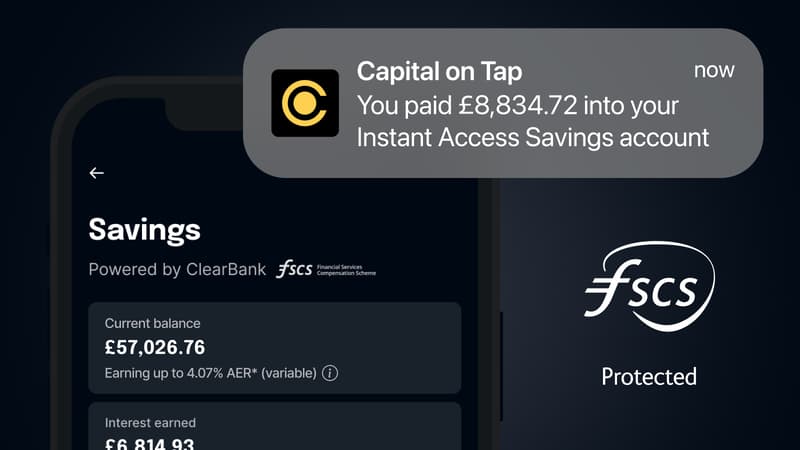

Boost your financial stability and supercharge your business growth with the Capital on Tap Instant Savings account, powered by ClearBank.

- Earn up to 4.07% AER* (variable) on your savings

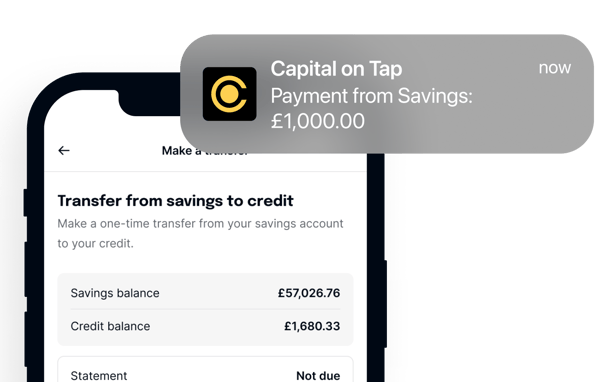

- Instant access to your funds with no withdrawal penalties

- Pay your credit balance from your savings

- FSCS protection up to £85,000 on eligible deposits