Trusted by over 200,000 businesses

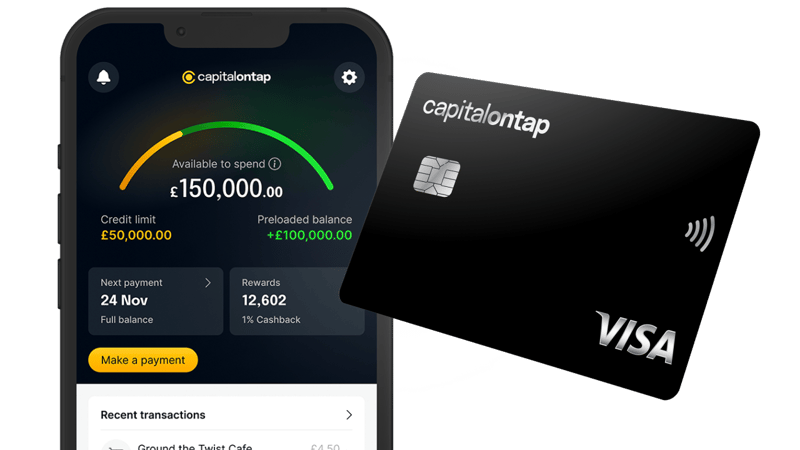

Unlock control over your cash flow with Preloading

Combine your own funds with your credit card balance to boost your spending power beyond your credit limit.

- Simplify accounting with both preloaded and credit spending on one monthly statement

- Take advantage of 1% cashback on all card spending

- Preload whatever amount you need, whenever you need it