Jump to a section

UK business borrowing following the pandemic hit record levels, with the highest amount recorded (£103.7 billion) by the Small Business Financial Markets since reporting began in 2012.

Even without the added pressure of recovering from a global health crisis and navigating a cost of living crisis, there’s always going to be the need to borrow money for business reasons. Whether it’s start-up funding, the cost of new equipment, or another of the myriad reasons for businesses to borrow money, it’s important to research which funding option is best for your circumstances.

Two of the main types of business credit are loans and credit cards. And, depending on your situation, either of them could be the right option. To help you decide which might be the better source of funding for your business, we’ve broken down the main differences between the two.

What is a small business term loan?

A small business term loan is a lump sum of money provided to a business for start-up costs, daily expenses, or relevant expansion projects. Once the acquired funds are spent, they will not be replenished.

Business loans typically come with an interest rate and repayment terms that the borrower must adhere to. The lender will assess the borrower's creditworthiness and the potential risk of the investment before approving the loan. Business loans are often a critical tool for companies to obtain the capital they need to grow and thrive.

What is a business credit card?

A business credit card is a payment card that a company or business owner can use to make purchases and manage expenses related to their business operations. Business credit cards function similarly to personal credit cards, with the primary difference being that they are specifically designed for business-related expenses. Business credit cards can help companies keep track of their expenses, manage cash flow, and earn rewards or cashback on their purchases.

The credit limit and interest rate for a business credit card are typically based on the company's creditworthiness and financial history. Using a business credit card responsibly can also help establish and build the company's credit profile, making it easier to obtain financing in the future. Like a loan, a credit card is paid monthly, and interest is applied and accrued as you use the provided funds.

Business loan vs. business credit card: what are the differences?

Borrowing amount

Business loan: Loans generally allow you to borrow higher amounts, however once the agreed amount has been loaned, you’ll only have access to that amount, unless you take out another, separate loan.

Credit card: Business credit cards typically offer lower monthly credit limits than the amount of a business loan, but they’re more flexible, credit limits can increase over time, and offer ongoing access to funds.

Repayment period

Business loan: Depending on the amount loaned and the agreed repayment schedule, you may be required to pay the same amount every month over the loan term (including interest), losing the option to prematurely pay off loan debt. Certain types of business loans require smaller monthly repayments with a large final payment, or ‘balloon payment’, at the end of the term, which can sometimes be a struggle for small businesses.

Credit card: Repayments are flexible. As long as you make the minimum monthly repayment (which is generally lower than loan repayments would be, depending on the level of credit), you’re free to pay an amount that suits your budget each month. This can be a great option if you’re looking to pay off debt faster if your cash flow grows.

Annual percentage rate (APR)

Business loan: Interest payments are based on the total principal amount you’re borrowing, and accrue straight away – whether you use the loan or not. Interest rates are typically lower than interest on a business credit card.

Credit card: Interest only accrues when you use your credit, and is generally calculated as APR (Annual Percentage Rate) but charged monthly. Interest rates on a credit card are typically higher than the interest on a loan. However, unlike loans, credit cards often have an initial interest-free period. That means that if you pay the full balance of purchases made on your card within that specified period, you don’t pay any interest.

Requirements

Business loan: Eligibility requirements will vary depending on the lender and type of loan you require, but generally your business will need to be established and running at a profit. Plus, you will need to have good business credit.

Credit card: Qualifying for a credit card is typically easier than being granted a loan. A good credit history will be important, but you can look for a provider that carries out ‘soft inquiries’ during the application process, which don’t leave a mark on your credit score.

Fees and additional costs

Business loan: There are many fees associated with business loans. Examples of common business loan fees include application fees, processing fees, origination fees, overdraft fees, late payment fees, and prepayment fees.

Credit card: Business credit cards may have an annual fee, transaction fees, interest charges for balances carried over, and late payment fees. Additionally, there may be other costs such as foreign transaction fees or fees for additional cards for employees.

Liability

Business loan: There’s no equivalent protection for loans like there is for credit card payments under the Consumer Credit Act. While you can get business loan protection insurance, once the funds are yours, they’re not protected in any other way and you are personally liable for its repayment.

Credit card: Payments are afforded certain protection under Section 75 of the Consumer Credit Act. If the seller has misrepresented their goods/services or breached their contract, you can claim from the credit card provider. However, you are still personally liable to repay your credit card debt.

Reason for funding

Business loan: A business loan itself is applied for and based on a business’ specific need – from purchasing new premises to access to working capital. You’ll be expected to provide the reason for the loan, either on your application or in the interview, depending on the lender and type of loan.

Credit card: Business credit cards can be used for any funding need, and you don’t need a specific purpose to apply for and take one out.

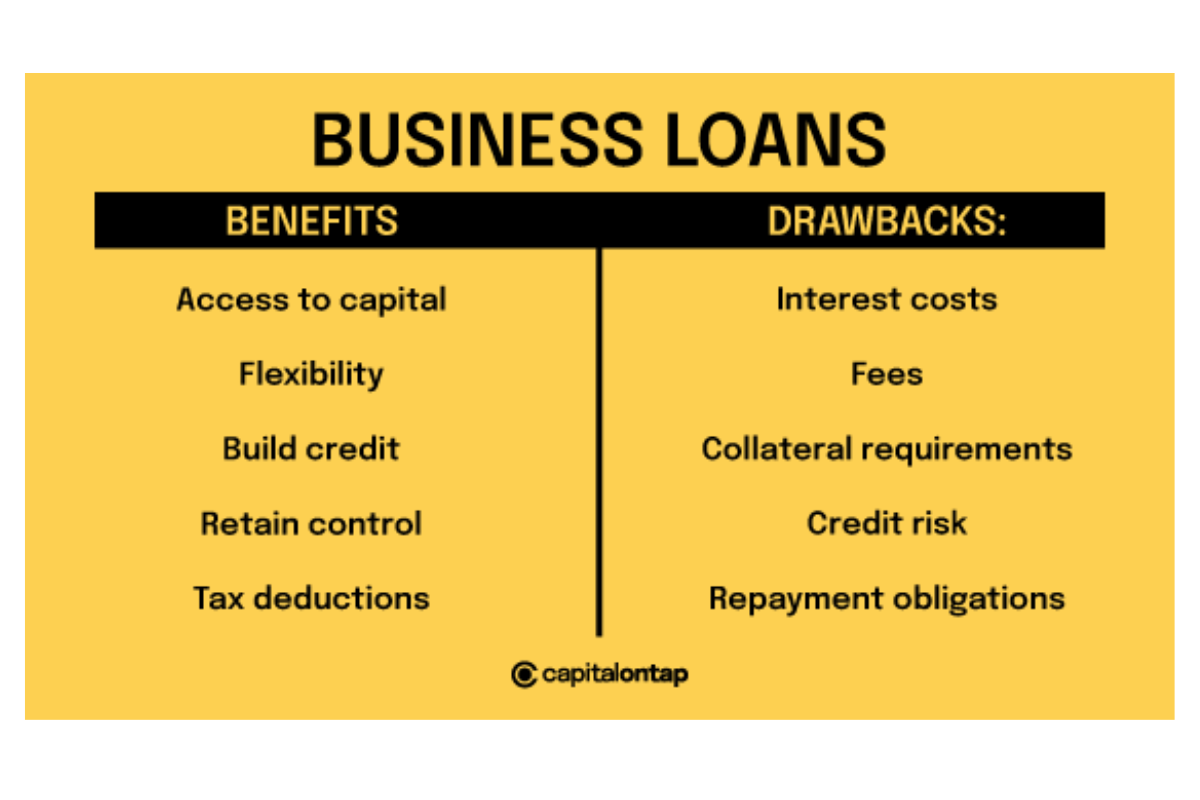

What are the benefits of a business loan?

Access to capital: Business loans can provide companies with instant working capital to cover expenses such as equipment purchases, inventory, and marketing campaigns, which can help grow the business.

Flexibility: Business loans come in many forms, including lines of credit, term loans, and equipment financing, each with different repayment terms and interest rates, which offer flexibility to businesses to choose the loan option that best fits their needs.

Build credit: Making timely payments on a business loan can help establish and build the company's credit profile, which can make it easier to obtain financing in the future.

Retain control: Unlike equity financing, business loans allow companies to retain full control over their business and do not require them to give up any ownership or decision-making power.

Tax deductions: Interest paid on business loans may be tax-deductible, reducing the overall cost of borrowing for the business. You should consult your financial advisor regarding this.

What are the drawbacks of a business loan?

Interest costs: While interest rates for business loans may be lower than other forms of financing, the interest costs can still add up over time, increasing the total amount that needs to be repaid.

Fees: Lenders may charge fees for loan applications, prepayment, or other loan-related services, which can increase the overall cost of the loan.

Collateral requirements: Some business loans may require collateral, such as property or equipment, which can put those assets at risk if the business is unable to repay the loan.

Credit risk: If a business is unable to repay a loan, it may damage the company's credit score, making it more difficult to obtain financing in the future.

Repayment obligations: Business loans come with repayment obligations that must be met, which can put a strain on a company's cash flow if they are unable to meet their payments on time.

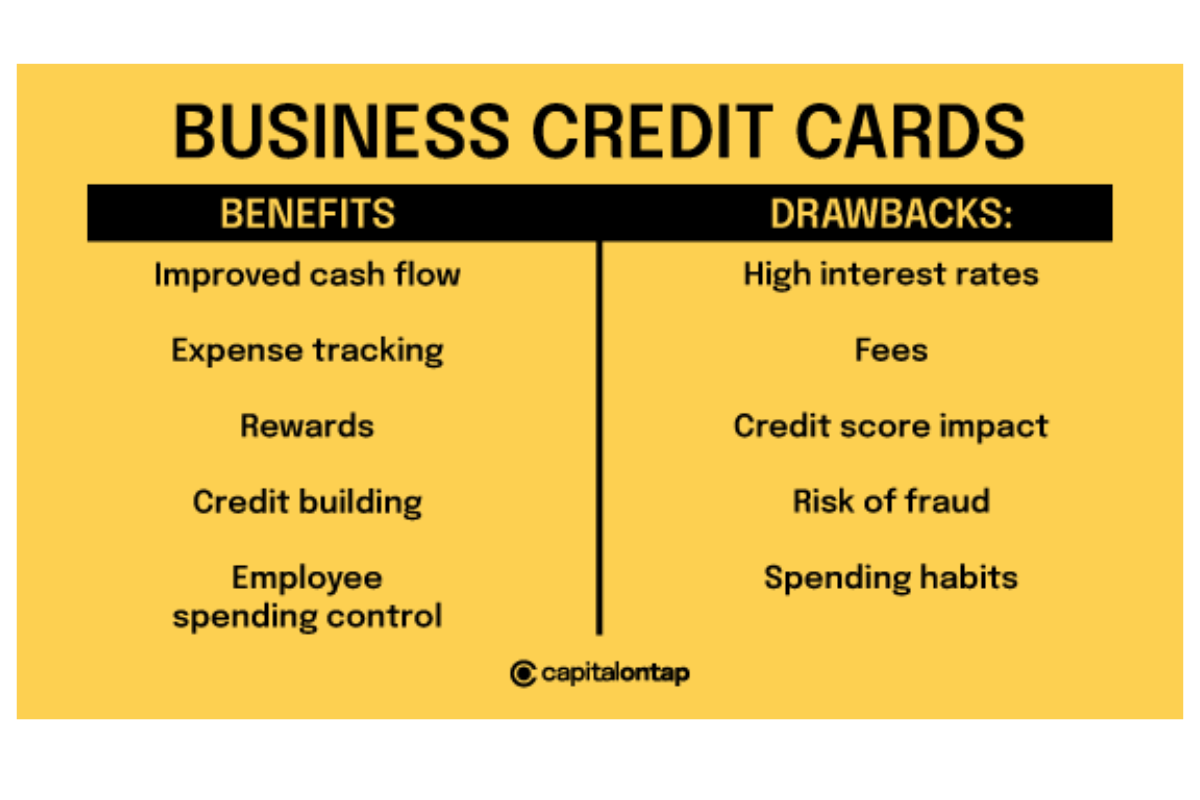

What are the benefits of a business credit card?

Improved cash flow: Business credit cards can help improve a company's cash flow by allowing for purchases and expenses to be made without using cash on hand.

Expense tracking: Business credit cards provide a convenient way for small business owners to track their expenses which can simplify bookkeeping and reduce the time spent on accounting tasks.

Rewards: Many business credit cards offer rewards programs, such as cashback, points, or exclusive discounts. These rewards can add up over time, providing additional benefits for companies.

Credit building: Using a business credit card responsibly can help establish and build a company's credit profile, making it easier to obtain financing in the future.

Employee spending control: Supplementary business credit cards can be issued to employees with pre-set spending limits, allowing for better control over company spending and reducing the risk of overspending.

What are the drawbacks of a business credit card?

High-interest rates: Business credit cards often come with higher interest rates than other forms of financing, such as business loans. This can result in significant interest charges if the balance is not paid in full each month.

Fees: Business credit cards may come with annual fees, late payment fees, and foreign transaction fees, among others. These fees can add up over time, increasing the overall cost of using the card.

Credit score impact: Late payments on a business credit card can negatively impact the company's credit score, making it more difficult to obtain financing in the future.

Risk of fraud: Business credit cards can be at risk of fraud or unauthorised purchases, particularly if employees have access to the card. This can result in financial losses and damage to the company's reputation.

Spending habits: Business credit cards can make it easier to overspend, which can result in financial strain if the balance cannot be paid off in full each month.

How to choose between a business loan and a credit card

Before you choose your method of borrowing, consider the needs of your business. Do you need a lump sum to spend once, or will you have ongoing expenses?

The interest on your loan will likely be overall smaller than the continuing interest charges of a business credit card. However, if you make full balance payments ahead of your due date, you will not incur any interest (with typical business credit cards).

If you are willing, you can get both a loan offer and a business credit card offer and compare their specific terms against each other.

The Bottom Line

Small Business Loans

If your business is established, with a long credit history and health revenue, and you’re looking for an injection of cash for a specific purpose (such as opening a new business location or purchasing high-value equipment), a loan might be a suitable choice.

You’ll be able to borrow a higher amount, but you’re likely to come up against stricter borrowing criteria and have less flexibility.

Business Credit Cards

For small or medium businesses looking for a continuous line of credit to support business growth and day-to-day cash flow needs, a business credit card could be the better option.

While your borrowing power won’t necessarily be as great, you’ll have much more flexibility, plus other perks you don’t get from a business loan. Small business credit cards from Capital On Tap offer the rates, rewards, and customer support that make running a business easier.

This does not constitute financial advice. If you want to understand your funding options in detail, you should speak to your financial advisor or accountant.