Jump to a section

Dreaming of becoming your own boss but not sure how much it costs to start a business? From creating your product, to marketing and branding, there are many expenses involved in getting a business off the ground.

Although there’s no one-size-fits-all answer we can give you, in this blog, we will explore the different expenses associated with starting a business, and provide valuable insights on how much it might cost to launch your new venture. So whether you're a first-time entrepreneur, or a seasoned business owner, this blog will provide you with the information you need to make informed decisions about your investment, and help you navigate the financial aspects of starting a business.

How to put together your estimated cost to start a business

The classic stereotype is small businesses die because they run out of cash. So when drafting your business plan, it’s a much better idea to overestimate your startup costs. This allows you to account for potential inflation and unforeseen expenses that may arise in the early stages of your business.

But, before you can even begin to consider the cost of starting your business, it's crucial to have a clear understanding of how your business will operate. Seeking expert advice about how to operate can be beneficial in determining the best legal and financial models that align with your business objectives.

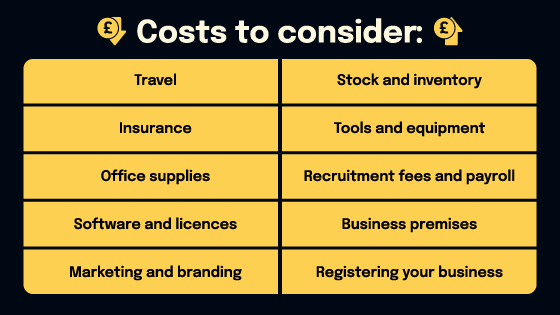

Once you understand how your business will operate, you can begin to consider your startup costs. Common startup costs business owners need to know include:

Registering your business

To operate legally, you'll need to register your business with the government. This will involve choosing a business name, registering your business structure, and obtaining any necessary licences and permits.

The cost of registering your business will depend on your business structure:

Sole trader: Registering as a sole trader is free

Limited partnership: Registering a limited partnership costs £20, and must be done by post

Limited liability partnership: Registering a limited liability partnership will cost £40 whether you complete your application online or by post

Limited company: Registering your limited company will cost £12 online, or £40 by post.

Business premises

The cost of office space or commercial premises will vary greatly depending on the town or city it’s located in, the size of the property, and the facilities available, such as car parking.

For example, in 2022, the cost of prime retail space in UK cities varied considerably, with London commanding a significantly higher rate than Bristol. Specifically, prices ranged from £2,000 per square foot per year in London to £85 per square foot per year in Bristol.

In addition to mortgage or rent payments, you’ll also be responsible for paying the utility bills such as electricity, gas, water, and internet.

Recruitment fees and payroll

Advertising open roles on job boards such as Indeed, or using a recruitment agency to find the right candidate will both incur fees. Once you’ve onboarded them, you’ll then have to budget for their salary, any potential overtime if relevant, along with pension and national insurance contributions.

Tools and equipment

If you’re looking to start a business in industries such as construction, automotive, or manufacturing, you’re going to need tools and equipment to operate.

When considering the costs of tools and equipment, think about factors such as the type of work you will be doing, the size of your business, and your budget. To ensure you get the best price, research suppliers that offer the tools and equipment you need and compare factors such as price, quality, delivery times, and customer service when choosing a supplier.

If purchasing equipment outright is not feasible, consider financing options such as equipment leasing or financing as these options can help you spread out the cost of equipment over time.

Stock and inventory

If your business plan is to sell goods, you’ll need to purchase stock and inventory so you’re ready to go when you open!

You also need to consider expenses related to stock and inventory, such as testing products, managing defective items, and dealing with surplus stock, as these have the potential to result in significant costs.

Marketing and branding

Marketing and branding are two essential components of building a successful business, but they can also be costly. Determine how much you can afford to spend in this area, and prioritise your efforts based on what will have the most significant impact on your business. Digital marketing is an effective and often more cost-efficient way to reach your target audience. Consider investing in social media advertising, email marketing, and search engine optimization (SEO) to increase your visibility online.

It's important to track the return on investment (ROI) of your marketing and branding efforts. This will help you determine what's working and what's not, and make adjustments as needed.

Software and licences

Most businesses require software and licences to operate efficiently. Examples include accounting and finance software for managing financial transactions, creating financial statements, and keeping track of taxes, or inventory management software to help businesses track inventory levels, manage orders, and optimise supply chain operations.

Office supplies

Whether for a home office or for a whole office floor, purchasing office supplies is an important expense when starting your own business. It's important to prioritise essential items such as computers, printers, and other necessary technology. These items may require a larger investment upfront but are critical to the success of your business.

Insurance

Business insurance offers a safety net against a variety of unforeseen circumstances that could arise when your business is operating. The cost of insurance will depend on the level of coverage you need and the type of business you are operating, and the industry you’re operating in. Generally, the cost of business insurance can range from a few hundred to several thousand pounds per year.

Whilst there is no legal requirement for businesses to have insurance in the UK, certain types of insurance may be mandatory, depending on your industry or the type of business you run. For example, if you have employees, you are required to have employers' liability insurance.

Travel

Not everyone starting a business will need to factor travel costs into their startup costs, but if your business will require you to visit clients or make deliveries to customers, you will be travelling a lot.

Being flexible with your travel plans can save you a significant amount of money. Consider travelling during off-peak times or booking tickets well in advance to take advantage of lower prices.

If you’re going to be travelling by car, ensure you ring fence enough funds for fuel and fill up at cheaper forecourts where possible.

What is the average cost to start a business?

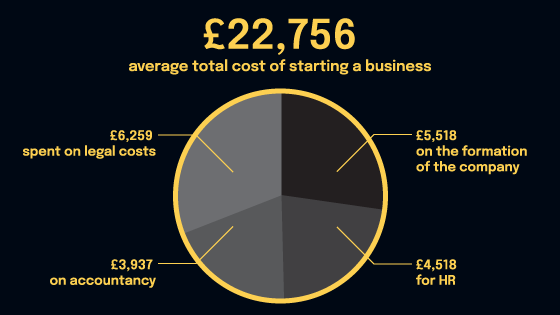

The average cost of starting a business in the UK is £22,756 in its first year, according to a recent study by HP.

This figure can be broken down into £6,259 spent on legal costs, £3,937 on accountancy, £4,518 for HR and £5,518 on the formation of the company.

Whilst having a ball-park figure can be helpful, don’t take it too literally. As you can, for example, immediately discount the HR fees if you’re starting your venture alone. Alternatively, note that this figure does not include any money spent on specific business costs, such as product development or buying stock, so if relevant, this will need to be factored into your calculations.

Can I start a business with no money?

Having no money doesn’t mean your business dream is over. Granted, having money would make starting a business easier, but it’s not impossible!

The easiest way to start a business with no money is to sell your skills and time, rather than physical goods. Low-cost business ideas include:

- Dog walking

- House sitting

- Cleaning

- Tutoring

How much does it cost to start business online?

Starting an online business is likely to cost far less upfront than launching a traditional brick and mortar business, such as a garage or coffee shop, as there’s no need to rent or buy a working space.

Online businesses tend to also have lower overhead costs; a website is available 24/7 to process sales, whereas a physical business requires premises, staff, and utilities to open. You’d still need to pay for electricity and your employees' wages, even if no sales are made throughout the day.

Despite this, setting up an online business shouldn’t be considered a ‘low-cost’ alternative as there are still expenses to consider, including:

- Website development: If you don't have the technical skills to build a website yourself, you may need to hire a professional web designer to create a custom site. The cost of web development can vary depending on the complexity of your website and the hourly rate of the designer.

- Domain registration and hosting: Once your website is developed, you will need to register a domain name and find a web hosting service. The cost of domain registration varies depending on the domain name and hosting package you choose. On average, domain registration and hosting can cost between £20 and £100 per year.

- Payment processing fees: To accept online payments, you will need to choose a payment processor. Popular payment processors like PayPal, Stripe, and Worldpay charge a percentage of the transaction value as a processing fee. These fees can vary from 1.5% to 3% per transaction.

- Business insurance: Just like any business, an online business needs insurance coverage to protect against risks such as cyber threats, product liability, and business interruption.

What are the different types of business costs?

When totalling up how much it will cost to start your business, you should also give some thought to the types of costs you will be paying as they can have a significant impact on the profitability and sustainability of your business.

One-time costs

Clue’s in the name. One-time costs are costs you only pay once, such as registration fees or purchasing a website domain.

Fixed or ongoing costs

Fixed costs don’t change, even if the level of output varies. For example, the cost of renting the factory where a business produces its goods will not change whether the business is producing 100 units or 1000 units per hour.

Variable costs

Variable costs relate directly to the production or sale of a product or service; if production increases, variable costs will also increase. For example, if a business producing children’s bikes pays its employees by the hour, hourly wage costs would increase at times where increased production is needed, such as before Christmas.

Essential costs

Essential costs must be made to keep your business alive. Without paying them, your business wouldn’t survive. Essential costs may include incorporation fees, purchasing stock, or hiring staff.

Optional costs

These are non-essential costs, such as a launch party or office decorations. You should not spend money on these costs unless you have the cash to do so without eating into your reserves.

Understanding these different types of costs is critical for any business owner who wants to succeed in today's competitive marketplace. Here are some reasons why:

- Budgeting and forecasting: Understanding the different types of costs can help you create a realistic budget and forecast for your business as some costs are predictable, whilst others aren’t. By accurately forecasting your costs, you can make informed decisions about pricing, sales targets, and profit margins.

- Pricing strategy: Knowing your costs is essential for setting prices that will allow your business to be profitable. If you don't understand the different types of costs, you may underprice your products or services and not generate enough revenue to cover your expenses.

- Cost control: Understanding the different types of costs can help you identify areas where you can reduce expenses and improve your bottom line. For example, if you have high fixed costs, you may need to focus on reducing variable costs to increase profitability. Or if you have high variable costs, such as labour and materials, you may need to look for ways to streamline your production process or negotiate better prices with suppliers.

The bottom line

As well as money, starting your own business will cost your time; it requires hard work, dedication, and a willingness to take risks. However, with careful planning and execution, it can be a fulfilling and profitable venture. By carefully considering these costs, and staying focused on your goals, you can successfully start and grow your own business.

When you’re ready for a line of credit to boost your small business growth, apply for a Capital on Tap Business Credit Card. Enjoy credit limits up to £250,000, uncapped 1% cashback, and unlimited cards for your employees.

This does not constitute financial advice. If you want to understand your startup costs in detail, you should speak to your financial advisor or accountant.