Jump to a section

Paying your employees a salary can be a smart move for businesses because it eliminates some of the guesswork when dealing with wage calculations. But what if your employee doesn’t work the contracted amount of hours or days in their pay cycle? In this situation and a few others, it’s essential to know how to calculate their salary pro rata.

What is pro rata salary?

A pro rata salary is calculated in proportion to a full-time salary, based on the actual hours or time an employee works. If an employee works fewer hours than a full-time schedule or only part of the year, their salary is adjusted accordingly.

For example, if a full-time salary is £50,000 for a 40-hour work week, but an employee works 20 hours per week, their salary would be £25,000. This method ensures fair compensation based on actual time worked rather than a fixed annual salary.

How to calculate pro rata salary?

To calculate an employee's pro rata salary, you'll need to know:

-

The employee's annual salary.

-

The total number of working days in a full year (this is usually 260 days for a standard 5-day workweek).

-

The actual number of days worked.

Steps to work out pro rata salary:

-

Divide the annual salary by the total annual working days to get the daily rate.

-

Multiply the daily rate by the number of days worked.

The result is the pro rata salary for that period. You can also substitute hours for days if tracking the employee’s hourly rate is more appropriate.

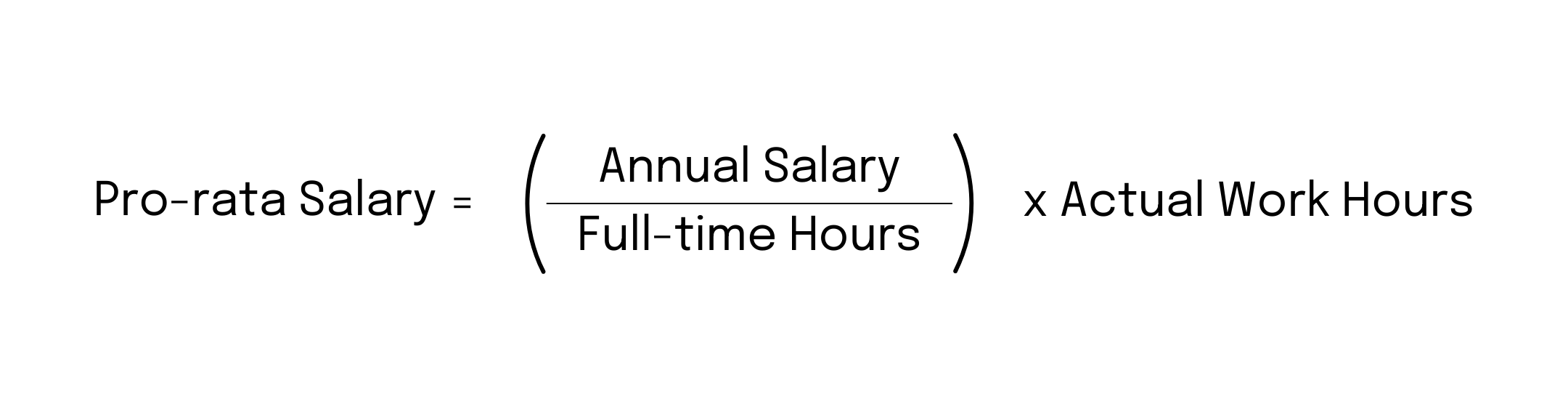

Or you can use the following formula:

Pro rata salary calculation example

Using the above formula, here’s an example:

How to work out pro rata salary for a pay rise

If you’ve given an employee a salary increase partway through a pay cycle, you’ll need to calculate a pro rata salary to reflect the increase.

1. Take the new salary and divide it by 52 to calculate their weekly rate

Yasmin’s new salary is £40,000. So her weekly rate (40,000/52) is £769.20.

2. Divide this weekly rate by the number of days worked

Yasmin works 5 days a week. So her daily rate (£769.20/5) is £153.8.

3. Minus the previous daily rate from the new rate

If you don’t know their previous daily rate, go back to the previous steps to work it out. Once you have, subtract it from the new rate.

Yasmin’s previous daily rate was £120.

£153.8 - £120 = £33.8.

4. Multiply the increase by the required number of days

Yasmin’s new salary will be in effect for 10 days of the current pay cycle.

£33.8 x 10 = £338.

5. Add the result to your employee’s monthly salary

Yasmin’s normal monthly salary was £2,600. Taking into account the 10 days of her salary increase, she will receive £2,938 (£2,600 + £338).

Then her new salary will permanently come into effect from the next pay cycle.

How to work out pro rata holiday

Pro rata holiday entitlement is calculated similarly to pro rata salary, ensuring part-time or new employees receive fair leave allocations.

-

Find the full-time annual holiday entitlement (e.g., 28 days for a full-time employee working 5 days per week).

-

Divide the full-time holiday entitlement by the number of full-time working days in a year (e.g., 28 / 260 = 0.1077 days per day worked).

-

Multiply this figure by the number of days the employee has actually worked.

For example, if an employee has worked 120 days in a year and full-time employees receive 28 days of holiday:

120 × 0.1077 = 12.92 (rounded to 13 days of holiday entitlement).

Of course, there may be some slight variations depending on your company's policies, but this method should give you a good starting point.

How pro rata salary affects benefits

According to the Part-Time Workers Regulations, part-time employees are entitled to the same benefits as full-time employees.

This means that if your business provides a pension plan to full-time employees, you must also offer the same benefit to part-time employees on a pro rata basis. It's not just limited to pay-related benefits, as part-time employees must also receive the same non-monetary benefits as their full-time counterparts.

For example, if full-time employees are given access to a gym membership or get their birthday off as annual leave, part-time employees should receive the same benefits. This ensures that part-time employees are not disadvantaged in any way and are treated fairly and equally in the workplace.

Should I hire part-time or full employees for my business?

Building a successful team is the cornerstone of any small business. But while there's no one-size fits all solution, deciding between part-time and full-time staffing can be tricky. Carefully weighing your options will ensure you recruit the best people to help your organisation thrive.

Advantages of hiring part-time employees

-

Flexibility: Part-time employees can be an invaluable resource for busy businesses. By offering increased scheduling flexibility and workload variability, they help to ensure that staffing levels remain in line with changing demand while providing cost savings during off periods.

-

Part-time staff are a cost-effective solution for businesses looking to reduce their overheads. With the ability to schedule employees in accordance with their needs, companies can save significantly!

-

Diverse skill set: Part-time employees can bring a diverse skill set and fresh perspective to a business. They may have experience in different industries or areas of expertise, which can be beneficial for a business looking to expand its skill set.

Disadvantages of hiring part-time employees

-

Training costs: With the hiring of part-time employees comes additional considerations - more training, increased supervision and a larger time investment than is typically required for full-timers. It's important to be aware that this may lead to greater costs upfront in order to ensure positive long term results.

-

Lack of continuity: Part-time employees may not be as invested in the business as full-time employees and may not provide the same level of continuity or consistency.

-

Limited availability: Although part-time employees offer much needed flexibility in staffing, their unavailability on short notice can present a challenge to businesses during unexpected circumstances.

The bottom line

Calculating pro rata salary allows businesses to provide just compensation even when staff work different hours. It's an important consideration when deciding whether part-time or full-time employees are the right fit for a business, since there can be hidden costs and paperwork involved in hiring less than full time workers. Carefully weighing all of these factors ensures that businesses make responsible decisions regarding their staffing needs - both now and in the future.

With understanding of how pro rata salary works, you can also manage equitable wages regardless of working hours, creating a workplace environment built on fairness and trust!

Frequently Asked Questions

How do you calculate part time salary?

Simply multiply the hourly rate by the number of hours worked to calculate your total earnings, minus any deductions that apply.

How do you work out day rate from salary?

Divide the annual salary by the total number of working days in the year.

What is pro rata?

Pro rata is a Latin term that means “in proportion.” It's commonly used in business to refer to distributing something fairly based on a given ratio.

What is pro rata used for?

It's commonly used in business to refer to the practice of reducing or increasing something in proportion to other amounts or variables. For example, if a company is hiring new employees but has limited time to train them, the training hours may be allocated pro rata among all new hires so that everyone gets an equitable amount of instruction.