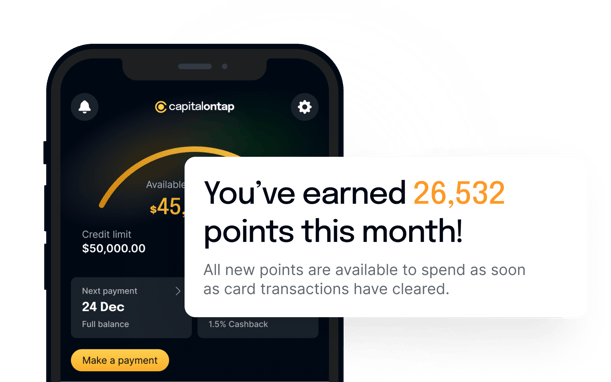

1.5% cash back on all purchases

The rewarding choice for small businesses

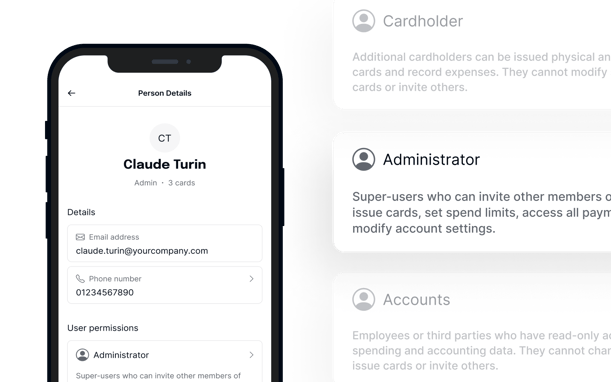

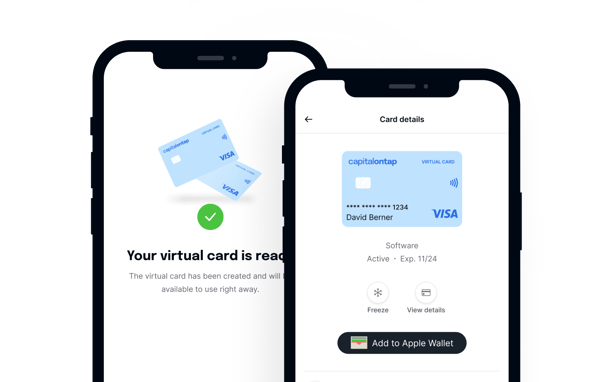

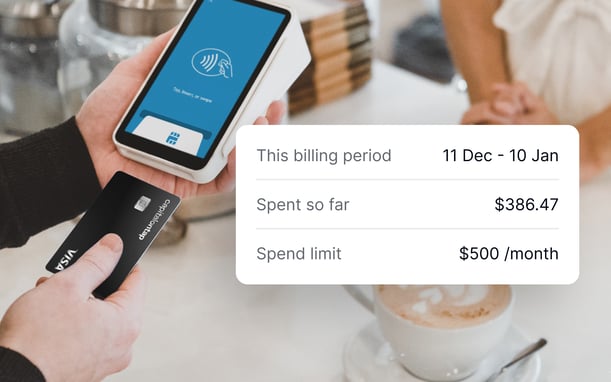

Handpicked business credit card benefits for small business owners - from cash back to cards for all your employees.

- Integrated accounting software

- 24/7 customer service

- No annual or foreign exchange fees