Welcome to the realm of business financing, where choices are akin to selecting the right tool for the job. In this scenario, you're faced with two options: a business line of credit or a business credit card.

Think of these options as brushes in an artist's collection. Each brush serves a distinct function, yet both contribute to the masterpiece in their own way. Both a business line of credit and a credit card offer the advantage of revolving credit, providing the flexibility to reuse funds. However, their differences define their effectiveness in different situations.

In this blog, we'll uncover the distinct characteristics of a business line of credit and a credit card, equipping you to make a choice that paints a successful financial picture for your business.

How does a business line of credit work?

A business line of credit is a financial arrangement that provides a business with access to a set amount of funds that it can borrow as needed - kind of like a financial safety net. It is a type of revolving credit, similar to using a credit card – you can borrow, pay back, and then borrow again. As soon as the money is repaid, you can borrow up to that limit again, only paying interest on the amount you borrowed - it's like having a pool of funds that you can dip into whenever there's a financial need.

Is there interest payable on a business line of credit?

Yes, you will pay interest if you use your business credit line.

If you have a business line of credit, interest is only applied to the amount you actually use, not the total credit limit, so you’ll only pay for what you borrow. But you will be charged interest from the day you start to borrow money until you have fully repaid it, unless you secure a line of credit with an introductory interest-free period.

Business line of credit interest rates and APRs can vary and depend on factors like your business and personal credit scores and the lender you choose. Because of their increased flexibility compared to bank loans or business credit cards, you may face higher interest rates when securing a business line of credit.

The interest rate on a line of credit is generally variable, which means it could change, either increase or decrease, during your credit period. This can make it difficult to predict how much the money you borrow will actually cost you.

Business line of credit approval process

Different business credit line lenders will have different requirements.

Lenders are likely to look at your personal and business credit scores, how long you've been in business, and your business plan. They might also want to see details about your business finances, like cash flow, accounts receivables, and bank statements, especially if you're looking to borrow a larger amount.

How long is a line of credit?

Lines of credit are issued for specific time periods, such as 12 or 24 months. Some can stretch up to five years, while others might be shorter, like 12 to 24 weeks.

During this time period, you've got what's called a "draw period." That's when you can dip into the funds available up to the limit set for your line of credit. So, as long as you're within that draw period, you can keep using your credit line.

Is there a credit limit on line of credit?

Yes, you’ll be given a credit limit if you take out a line of credit. The amount of credit you're granted depends on factors like your credit score, your business history, and your financial situation.

If you have something valuable to use as a backup, like a promise that you'll pay back, you could get permission to borrow more money. This is called collateral, and it can help you access a bigger borrowing limit.

There are two types of lines of credit: secured and unsecured. If it's secured, meaning you provide collateral, you could potentially get a higher borrowing limit. On the flip side, an unsecured line of credit doesn't require collateral, but there could still be certain conditions or terms you need to meet.

How is a business line of credit paid pack?

Paying back a business line of credit is pretty straightforward. You only need to return the money you borrowed, plus any interest that has accumulated.

The good news is that you have some flexibility in how you pay it back – you can do it all at once or in smaller chunks, as long as you meet the terms you agreed upon with your lender.

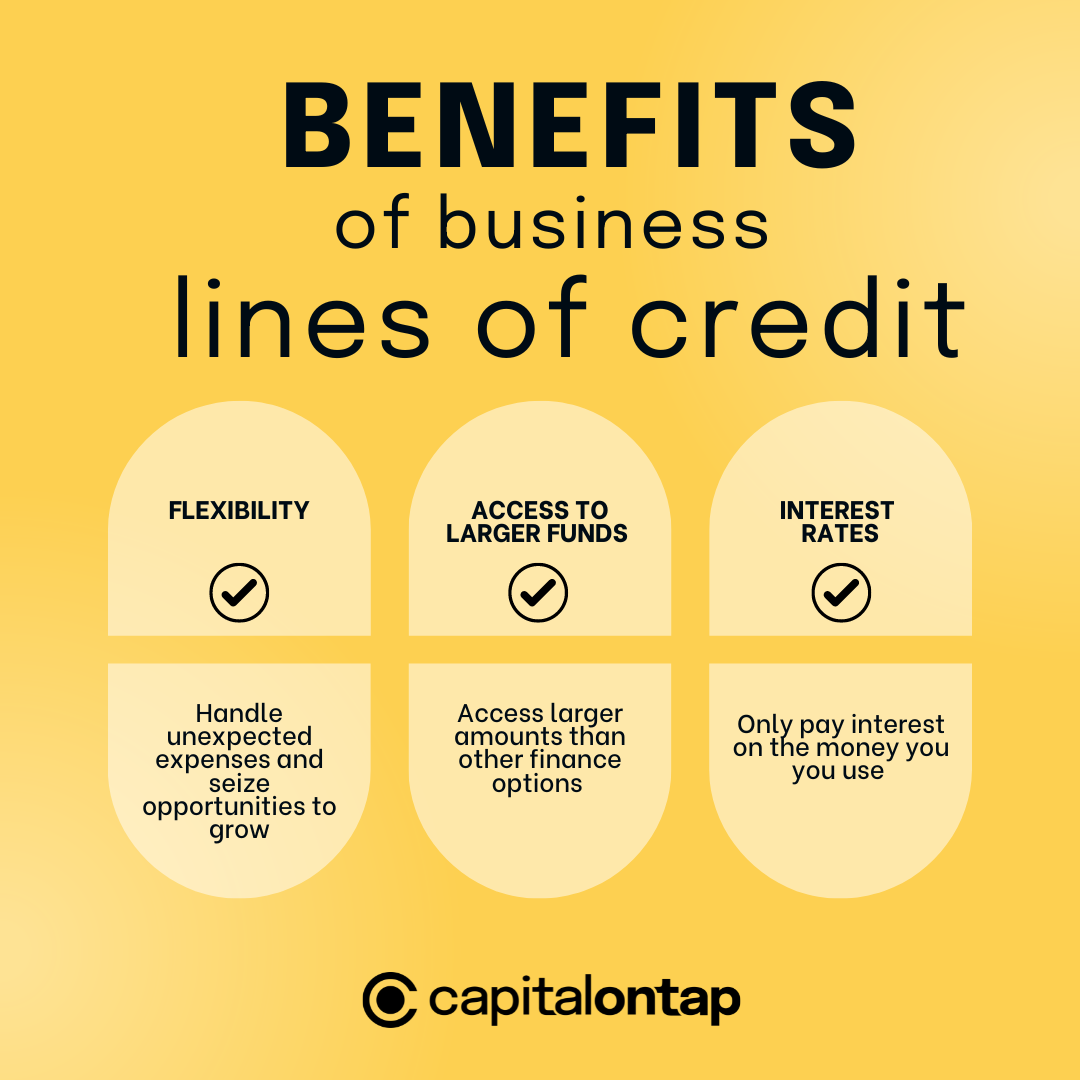

Benefits of business lines of credit

Business lines of credit offer a range of advantages that can boost your business’ financial strategy. These benefits include:

Flexibility

You have the freedom to use credit line funds when and how you need them. Whether it's handling unexpected expenses, bridging gaps in cash flow, or seizing growth opportunities, a line of credit lets you access cash on your terms.

Access to larger funds

Need a substantial amount for a major project? A business line of credit can give you access to larger funds than what's typically available through other short-term financing options. This means you can take on bigger ventures without worrying about running low on capital.

Potential lower interest rates

Compared to some other financing options, business lines of credit often come with the potential for lower interest rates. This can translate to cost savings over time, especially if you pay back what you borrow relatively quickly. Lower interest means more of your money stays in your business's pocket.

How does a business credit card work?

A business credit card is a payment card that a company or business owner can use to make purchases and manage expenses related to their business operations. Business credit cards function similarly to personal credit cards, with the primary difference being that they are specifically designed for business-related expenses. Business credit cards can help companies keep track of their expenses, manage cash flow, and earn rewards or cashback on their purchases.

Business credit card limits

Business credit card limits are the maximum amount you can spend using the card. These limits are usually determined by your creditworthiness, business income, and other financial factors. While having a higher credit limit can give you more flexibility, it's essential to use the card responsibly and within your means to avoid debt.

With a Capital on Tap Business Credit Card you could grow your business with a credit limit of up to £250,000.

Do you pay interest on a business credit card?

Yes, you might have to pay interest on a business credit card, but it depends on how you use it. If you pay off your balance in full before the due date, you can avoid interest charges. However, if you carry a balance from month to month, interest will apply to the remaining amount. To make the most of your business credit card, try to clear the balance each month to save on those interest fees.

Business credit card flexibility

Business credit cards are all about giving you financial freedom. They let you make purchases for your business whenever you need to, even if you're waiting for funds to come in from unpaid invoices. This flexibility can help you manage cash flow, cover unexpected expenses, and seize opportunities without delay.

Credit card billing cycles

Billing cycles are like the rhythm of your credit card activity. It’s the time between your statement dates. During this period, you're making purchases, and those transactions get compiled into your billing statement. Understanding your billing cycle is crucial because it determines when your payment is due and when interest charges might apply. By keeping track of your billing cycles, you can stay on top of your payments and avoid any surprises.

With your Capital on Tap card, you can switch your repayment option from monthly to weekly full balance repayments if you’d like to repay more regularly.

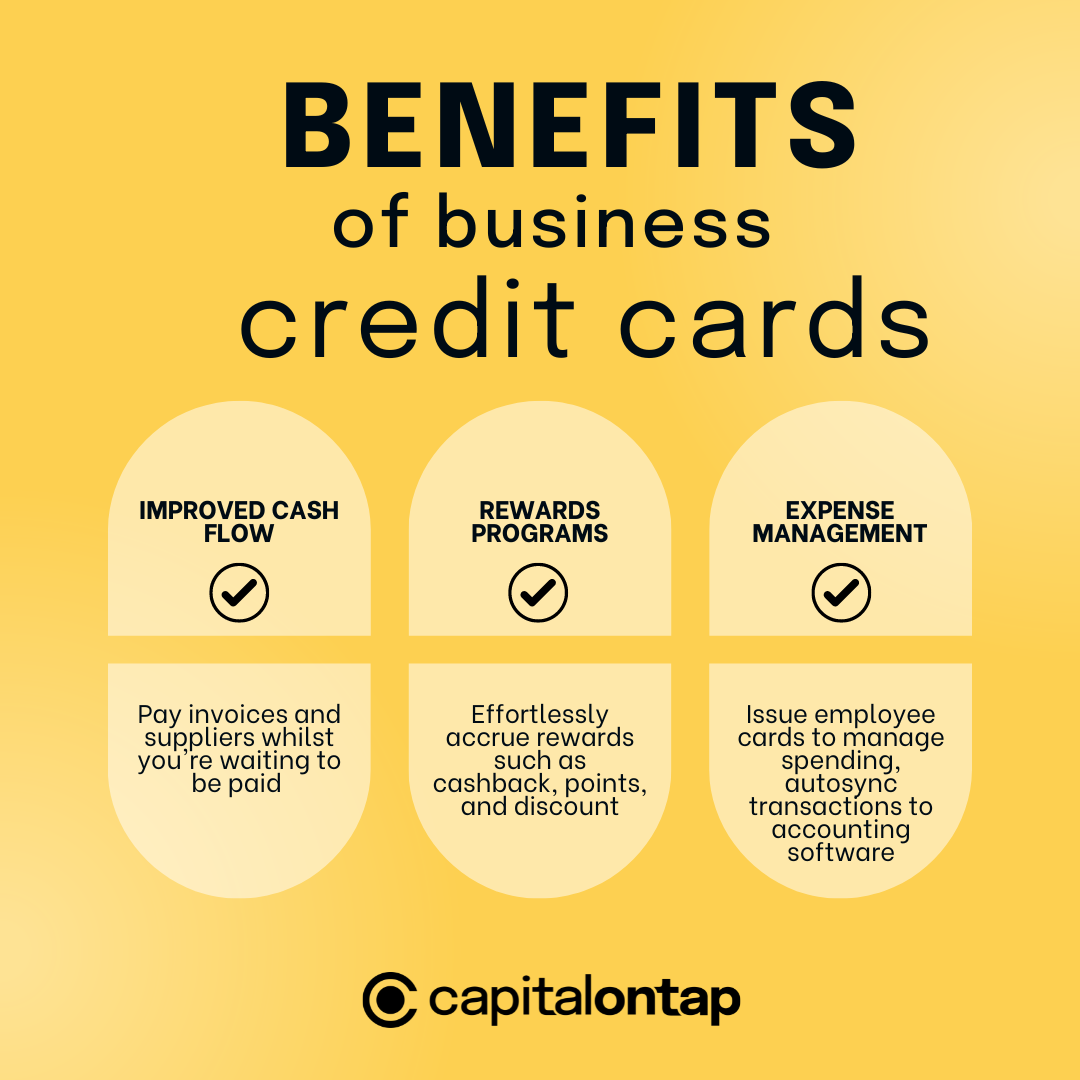

Benefits of a business credit card

A business credit card isn't just a piece of plastic; it's a versatile tool that can offer a range of advantages to help your business thrive:

Improved cash flow

Business credit cards can be a lifesaver for keeping the cash flowing. Instead of using up your cash, you can make purchases and cover expenses with your card. It's like having a financial safety net that lets you keep your cash handy for other important stuff.

Rewards programs

Many business credit cards offer rewards programs, such as cashback, points, or exclusive discounts. These rewards can add up over time, providing additional benefits for companies. This way, you can effortlessly earn rewards with your business spending.

Earn 1% cashback on everyday business spending like bills, operating costs and general expenses when you use your Capital on Tap Business Credit Card. Redeem points against your balance, for cash, or for gift cards. Upgrade to Business Rewards to earn bonus points and redeem for Avios.

Expense management

Business credit cards provide a convenient way for small business owners to track their expenses which can simplify bookkeeping and reduce the time spent on accounting tasks. For example, with a Capital on Tap Business Credit Card auto syncing your transactions with your accounting software, creating users with personalised account access, and attaching uploads of your receipts to your transactions are just a few of the ways a business credit card can help you get a handle on your expenses.

Employee spending control

Supplementary business credit cards can be issued to employees with pre-set spending limits, allowing for better control over company spending and reducing the risk of overspending.

Comparing key factors: Business line of credit vs. business credit cards

When it comes to managing your small business’ finances, choosing between a business line of credit and a business credit card can be a crucial decision. Let's break down some essential points to help you make an informed choice:

What's the difference between a business credit card and a business line of credit?

Both a business line of credit and a business credit card provide access to funds, but they have distinct differences. A business line of credit offers cash that can cover various expenses that you might not be able to put on a credit card. For instance, paying for payroll or property leases is typically not possible with a credit card.

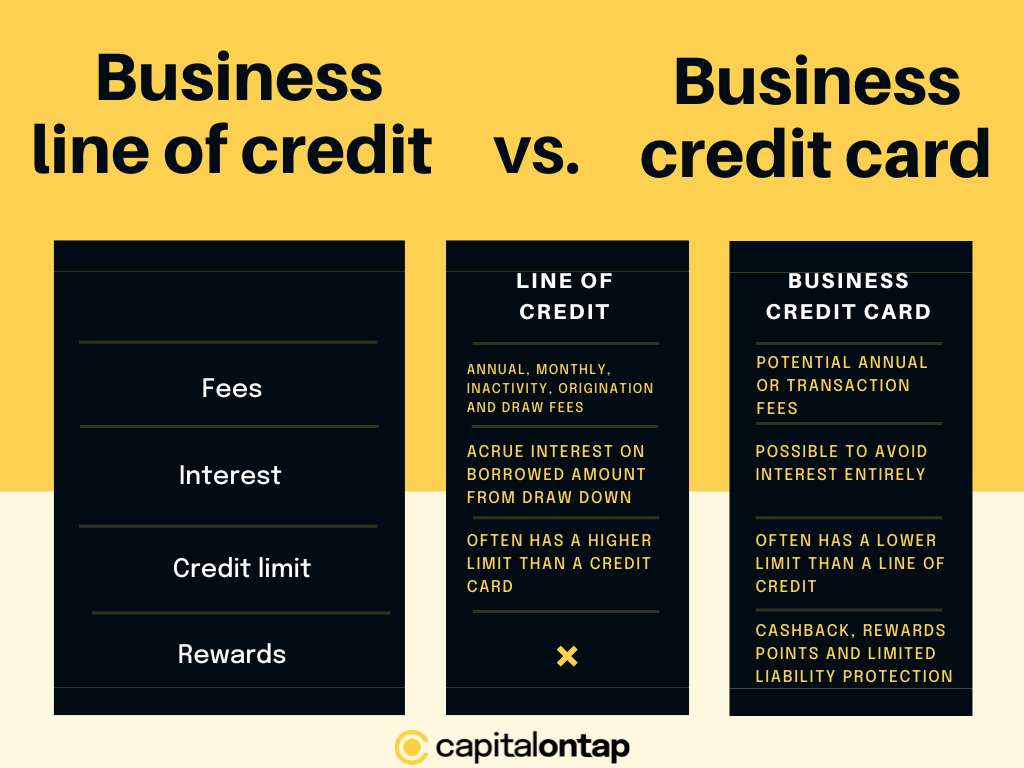

Interest rates

Business credit cards usually carry higher interest rates than lines of credit. However, credit cards present the opportunity to avoid interest charges entirely by paying off the balance each billing cycle. In contrast, a line of credit starts accruing interest on the amount you draw from day one.

Fees

Both business lines of credit and business credit cards might come with associated fees. Credit lines could have annual, monthly, or inactivity fees, along with origination or draw fees. Credit cards may carry an annual fee, though some options don't. Additional fees for credit cards could include charges for foreign transactions, balance transfers, cash advances, and late payments.

Credit limits

While you won’t know your account’s credit limit until after you apply and get approved, a line of credit often has a higher limit than a credit card.

Rewards

With a business credit card, you can accrue cashback and rewards points among other benefits. You also have limited liability protection on purchases you make on your business credit card. You don’t get either of these benefits with a business line of credit.

When to use a business credit card vs a business line of credit

They can be most useful when used together; credit cards excel for routine expenses and earning rewards, while a business line of credit suits purchases incompatible with cards or larger expenses exceeding limits, offering lower rates and higher limits with collateral options.

Is it better to pay with a credit card or line of credit?

Deciding between using a credit card or a line of credit depends on your business’ financial situation.

Use a business line of credit when:

- You can't use a card: You can't use credit cards for all kinds of business expenses. For instance, things like paying employees, getting services from vendors, or leasing might not work with cards.

- You can't immediately pay off your balance: If you can't pay off your full balance every month, a business line of credit might be a smarter choice than a credit card because it generally has a lower interest rate.

- You're making a large purchase: A business line of credit often offers more cash than other quick financing options, giving you the freedom to take on bigger ventures without capital concerns.

- You don't know how much the project will cost: Opting for a business credit line when uncertain about project costs makes sense because it provides a safety net of funds. With a credit line, you're prepared for potential expenses that may arise, ensuring your project can progress smoothly even if the exact costs are unclear upfront.

Use a business credit card when:

- You want to build credit: When you use your business credit card and make sure to pay what you owe, you're showing that you handle credit wisely. This helps improve your credit and make it easier for your business to get more credit in the future.

- You can pay off your balance: Using your business credit card for purchases you're confident you can pay off is a smart move. It's like spending within your means and knowing you've got the cash to cover it. This practice not only keeps your finances in check but also helps build a positive credit track record for your business.

- You're making an everyday purchase: A credit card simplifies keeping tabs on everyday transactions, which is super handy, especially for regular automatic payments. Plus, some cards give you extra rewards for common business stuff, like utilities and office supplies. It's like earning a little perk for just doing what you do.

- You want protection on your purchase: Business credit cards often come with some form of protection to help you if your purchase is faulty, broken, or never arrives. Your business credit card also protects you against any losses due to fraud, stolen or misuse of credit cards

- You want to earn rewards: Having a business credit card can score you some great bonuses for your spending, like cashback or other rewards. Just remember, it's good to pay off what you owe every month to make the most of the rewards you've earnt

Is it bad to have a line of credit and not use it?

Having a line of credit that goes unused isn't inherently bad, in fact, it can be a strategic move. For example, imagine you have a line of credit with a £100,000 credit limit. Right now, you don't owe anything and haven't used the credit in a while. Having this unused credit isn't necessarily a bad thing - it's like having a safety cushion. If something unexpected comes up, like a sudden bill or repair, you can use your credit to cover it.

However, it's important to strike a balance. While not using a line of credit won't have a direct negative impact, not using any credit at all can result in a lack of credit history, potentially affecting your creditworthiness.

The bottom line

Choosing between a business line of credit and a business credit card boils down to informed decision-making. Each option offers its own benefits. A business line of credit provides flexibility, while a credit card simplifies transactions and cash flow management. Both a business line of credit and a business credit card will require repayment as you are entering into a binding credit agreement, remember if you are ever struggling to repay a line of credit or credit card you can always communicate this to the provider of the product to discuss affordable ways to make repayment. If you have questions or concerns about the suitability of either option for your business, you should speak with your financial advisor or accountant.

To make the right choice, weigh the pros and cons – interest rates, fees, credit limits, and rewards – against your business objectives. Remember, these tools can complement each other, allowing you to create a solid financial strategy that aligns with your business's growth.

This does not constitute financial advice. If you want to understand credit financing options in detail, you should speak to your financial advisor or accountant.