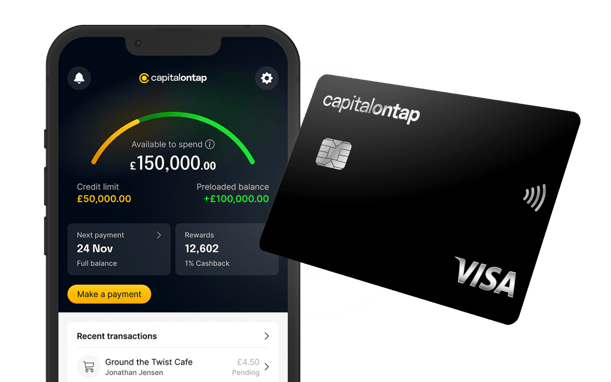

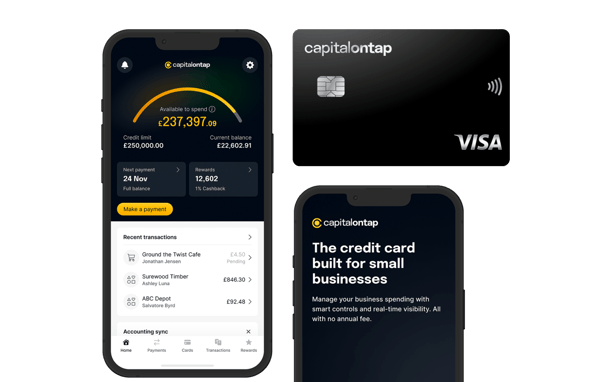

Practical credit limits up to £250,000

The business credit card that's more rewarding

Get more from your business spending. Access funds, higher credit limits, and rewards, all designed with your small business in mind.

- 1% cashback on all card spend

- No annual, FX, or ATM fees

- Convert points to Avios for free